Long-Term Care Awareness Month Preparation

Let's use October to answer the questions EVERYONE in the advisory community must ask.....

1. What does Long-Term Care actually mean to your client?

If you don’t know THEIR definition, you have an assumption that may or may not result in adequate or suitable planning. To ensure everyone is on the same page, their answer must convey an understanding of ADLs and care delivery based on the information found in the graphic to the right.

Please email us for a PDF version of "Understanding How and Where Care Can Be Provided" or include a logo and we'll customize one for you......

2. How do you quantify future Long-Term Care needs based on health, lifestyle, and family dynamics?

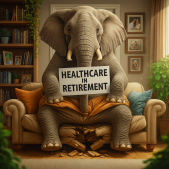

The Lumiant HALO (Health Analysis & Longevity Optimizer) helps your clients plan for Healthcare In Retirement by projecting extended care needs not covered by Medicare. It estimates the type, location, and duration of care, along with total out-of-pocket LTC costs across their lifespan. By clicking the graphic to the left and completing a HALO Assessment, you’ll take a vital step in quantifying the impact of Long-Term Care and setting meaningful targets for comprehensive planning.

3. What are the client's LTC preferences if/when care is needed?

When the LTC planning discussion begins, the advisory community almost always jumps to “how will the client pay for care?”—but no one stops to ask “paying for what?” Care isn’t just a dollar figure; it’s people, places, services, coordination, quality, timing, and family involvement. Without first defining what care looks like and how that aligns with the HALO Assessment, any conversation about how to pay for it is a sign that this topic is not being taken seriously.

4. How do you explain the current and future costs of LTC for your client?

No other financial planning discipline wastes more time with bad stats and outdated methods than LTC Planning. Too many advisors keep parroting “$100K a year in a nursing home” as if that number has meaning, while ignoring how care actually plays out over five, ten, or more years — and how inflation compounds the damage. Real LTC Planning requires data-driven, client-specific metrics, and the moment the word “average” comes out of your mouth is the moment your client should seriously question your qualification to address any planning topic of significance.

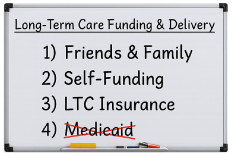

5. What is Medicaid, and how does it relate to LTC Planning today?

Medicaid is not a LTC Planning strategy — it’s the poverty safety net, or at least that was its intent. While the program exists to protect those with no other resources, too many advisors and attorneys pitch “Medicaid Planning” as if it were a wealth management tool to preserve estates, lifestyles, or family legacies. Set aside the wisdom or utility of the concept for a moment and realize that gaming the system may work today, but the future paints a harsh reality: if Medicaid looks anything like it does now, beds will be limited, quality will be inconsistent, and states will have no choice but to impose drastic changes as the Silver Tsunami brings a drowning demographic deluge.

In practice, Medicare is a trap that means the client relinquishes control over where care is received, how it’s delivered, and whether a spouse or heirs are left with anything meaningful as intended. Today, Medicaid isn’t a LTC Planning strategy — it’s evidence of advisory failure to meet Know Your Client, Best Interest, or fiduciary standards.

6. What % of your client's assets are currently allocated to pay for healthcare excluded by Medicare?

.....Because until an American qualifies for Medicaid, every dollar, in every account, at every institution, is already allocated to pay for Healthcare in Retirement. That default allocation will not change until appropriate and suitable planning is put in place.

The advisory community operates under a dangerous misconception: that ignoring this reality and leaving clients in the default position of self-funding somehow satisfies their professional responsibilities. In truth, doing nothing is not neutral — it’s a dereliction of duty that exposes every client dollar to unbounded healthcare liability.

7. If care is needed tomorrow, what account would your client tap to pay for it?

Universally, there is no plan — only an assumption, and it’s usually wrong. The advisory community’s most common response is not rooted in planning, but in feeling, thinking, or believing a client wants to self-fund future Long-Term Care needs.....without presenting any options!

Rather than implementing a proactive plan, the advisor leaves the client exposed until a crisis hits and chaos ensues. The result? Higher costs, heavier family burden, greater tax consequences — all with zero concern for timing or potential leverage.

8. How much of your client’s other planning depends on assets that could be consumed by LTC costs?

Advisors and consumers like to believe assets are fungible — that dollars for income, growth, or legacy can be shifted around at will. But the moment Long-Term Care is needed, that theory collapses and those “fungible” dollars are consumed first.

- For the middle market, retirement income becomes suspect.

- For the mass affluent, lifestyle goals are disrupted.

- For HNW families, legacy and philanthropic intent must be re-evaluated.

Without planning, fungibility is a myth as every dollar, no matter what it was meant for, instantly becomes a care dollar.

9. What accounts could a client "upgrade" to be better positioned for LTC Planning needs?

After identifying your client’s “pay for” accounts, a determination must be made on how — not if — to reposition or reallocate part of those assets into an insurance solution. Without that step, every account remains nothing more than a self-funding bucket — exposed to taxes, liquidation risk, and unbounded liability.

The advisory community will soon be forced to admit what the math already proves: insurance solutions deliver a higher success rate than any self-funding strategy ever can. With that step, those same accounts are upgraded into tools that provide leverage, protection, and purpose.

10. If you’re not licensed, credentialed, or trained in Long-Term Care Planning, who should their attorney call when your client’s “plan” falls apart?

The point isn’t to insult anyone — it’s to expose a blind spot. You need a license to give tax advice. You need a license to draft legal documents. You need a license to manage investments. But when it comes to Long-Term Care Planning — one of the biggest financial and emotional risks clients will ever face — too many professionals speak with confidence but no credentials, no training, and no partnerships with those who do.

The question, “Who should their attorney call when your client’s plan falls apart?” isn’t hypothetical. It’s about accountability. If you’re not licensed, credentialed, or trained in this space — and you don’t collaborate with someone who is — you’re not helping your client plan; you’re setting them up for crisis and chaos.

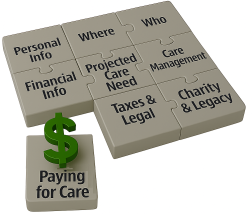

11. What is your process to differentiate between planning for care vs. paying for care?

Planning for care defines the who, what, when, where, and how care will be delivered, managed, and supported, while paying for care simply addresses the resources that will cover those costs. Most advisors jump straight to the “pay for” conversation — usually without identifying which specific account will fund care — never addressing the far more personal and complex “plan for” component.

Without that planning, funding decisions are made in a vacuum, leaving families to coordinate everything else in crisis mode rather than following a predetermined course of action. Furthermore, failing to engage in the “plan for” aspect directly conflicts with Know Your Client (KYC), Best Interest, and Fiduciary standards. In short, Long-Term Care Planning isn’t optional — it’s your job.

12. When you ignore insurance-based LTC planning solutions in favor of self-funding, can you explain the enhanced liquidity, tax efficiency, and leverage of your recommendation?

The simple answer here is that, regardless of how you contort the response, no one can explain it because liquidity, tax efficiency, and leverage cannot be enhanced by self-funding.

When you recommend self-funding over insurance-based Long-Term Care (LTC) solutions, you’re effectively admitting that you’re unprepared to adequately address the topic. Self-funding can be a plan — but only when it’s deliberate, documented, and measured against alternatives. Without that process, it’s not a strategy, it’s just an assumption masquerading as advisory expertise.

13. When was the last time you toured a senior community or met with a rep from a home care agency?

If your answer is anything longer than “recently,” then your credibility to discuss Long-Term Care must be questioned.

The physical care environments or the delivery of care, its costs, and quality are critical for clients to understand why the “plan for” matters as much as the “pay for.” Without a firsthand perspective, your conversations remain theoretical — and theory doesn’t prepare families for the reality of LTC.

14. Do you have clients expecting adult children to become caregivers, and what is the plan when they're wrong?

If your clients expect their adult children to become caregivers, you need to challenge that assumption immediately. The reality is that most adult children are geographically distant, financially stretched, emotionally unprepared — or, more to the point, simply don’t want the role.

Without an agreed-upon plan, what starts as an “expectation” quickly becomes a family crisis fueled by guilt, resentment, and chaos. If there’s no clearly defined alternative, placing that expectation on adult children or loved ones is nothing more than wishful thinking. Across the advisory community, we must confront that disconnect and proactively pivot toward executable plans that provide true multigenerational security.

15. How do you address ever-increasing care costs in a client’s Long-Term Care Planning?

If your LTC Planning conversations don’t include how to address the increasing cost of care, then you’re not planning — you’re guessing. The cost of care doesn’t just rise; it compounds. Ignoring inflation, labor shortages, and market dynamics guarantees that today’s “adequate” plan will be tomorrow’s shortfall.

Real planning requires stress-testing assumptions, matching benefits to inflation, and leveraging insurance-based solutions that automatically grow to keep pace with rising costs. The alternative is leaving clients exposed to an expense curve that outpaces their income, erodes their assets, and devastates family options when care is needed. In short, maintaining Know Your Client (KYC), Best Interest, and Fiduciary standards requires quantifying future care costs.

16. Describe how your client's LTC Planning works without a comprehensive legal framework?

If your client’s LTC Planning doesn’t include a comprehensive legal framework, then it doesn’t work — it collapses at the first point of conflict. Powers of Attorney, Health Care Directives, HIPAA releases, and properly aligned ownership or beneficiary structures are not optional; they’re the control system for every decision that follows.

Without legal alignment, even the best financial strategy becomes unenforceable when care is needed. Families find themselves locked out of accounts, unable to authorize care, or worse — forced into guardianship court just to manage daily decisions. LTC Planning requires integration between financial, legal, and healthcare directives. Anything less isn’t planning — it’s paperwork. Regardless of the advisor–client relationship, the failure to recognize the absurdity of the self-funding default and an absent legal strategy is bordering on negligence.

17. New account form, margin agreement, options agreement, tax returns, wills/trusts, investment policy statement, etc. - How are you assessing risk and documenting your client’s intentions for Long-Term Care?

If every other financial decision requires documentation, disclosure, and suitability review, there is no justification for leaving Long-Term Care to verbal assumptions and unchecked intentions. You can’t claim to know your client if you haven’t documented how they intend to manage the financial, emotional, and logistical risks of needing care.

New account forms, margin agreements, options disclosures, tax returns, wills, and trusts all memorialize intent — LTC Planning deserves the same discipline. Without documentation, there’s no evidence of advice given, options presented, or decisions made. That’s not prudence — that’s exposure.

Assessing LTC risk and documenting client intent isn’t just good practice; it is quickly becoming a compliance imperative across the financial services spectrum. If it’s not in writing, it doesn’t exist — and when care is needed, “we talked about it” won’t hold up to scrutiny.

18. When do you recommend declining Comprehensive/Collision coverage on a car, cancelling homeowner’s insurance on mortgage-free homes, or opting out of Medicare? If not, what's your logic for self-funding LTC?

You don’t recommend declining comprehensive or collision coverage on an expensive car, cancelling homeowner’s insurance on a mortgage-free home, or opting out of Medicare — because doing so would be reckless. Yet somehow, self-funding Long-Term Care has become the exception to every rule of prudent risk management.

Even the wealthiest clients maintain homeowner's insurance and comprehensive/collision coverage on high-end vehicles — not because they can’t afford the loss, but because they understand risk transfer makes sense even when self-funding is possible. So why does that logic disappear when the potential loss involves one’s health, independence, and legacy?

Self-funding isn’t a mark of affluence; it’s evidence of flawed reasoning. The same financial professionals who insist on protecting homes, portfolios, and property routinely ignore the single most predictable and devastating financial event in retirement. That’s not planning — it’s professional inconsistency.

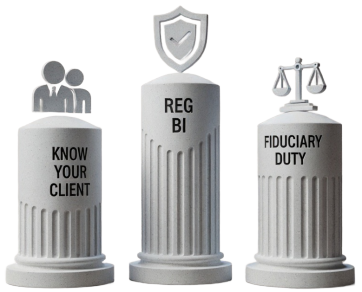

19. Whether it's Know Your Customer, Reg BI, or a fiduciary standard, explain the compliance blind spot to HIR and LTC, and who owns that gap in your firm?

Whether the firm, rep, or advisor operates under Know Your Customer (KYC), Regulation Best Interest (Reg BI), or a formal fiduciary standard, each framework requires that advisors:

-

Identify all material risks relevant to a client’s financial objectives,

-

Evaluate and disclose those risks, and

-

Recommend strategies in the client’s best interest.

Yet nearly every firm omits healthcare and long-term care (LTC) exposure—the single most foreseeable and financially disruptive risk in retirement—from its supervisory, suitability, and disclosure procedures.

This is the Healthcare in Retirement and LTC compliance blind spot, where advisors must document market risk tolerance, but not care risk exposure. Where firms monitor asset allocation, but not liquidity erosion from health events. And where supervisors review death benefit and longevity projections, but not morbidity risk. Until that gap is closed, firms are functionally out of compliance with their own “know your client” and “best interest” mandates.

Who Owns the Gap? Everyone does, but no one is currently accountable when advisors fail to address a known, modelable risk, when supervisors and OSJs don't require documentation of the LTC discussion, or when firms and Compliance Officers fail to define a standard for healthcare risk disclosure. Ownership begins the moment this question is asked: “If your firm can’t demonstrate that healthcare and LTC risks were discussed, modeled, and disclosed, how can it prove the client’s plan was in their best interest?”

20. If the #1 retirement risk is running out of money, how are you mitigating that risk by ignoring risk #2 — Healthcare and Long-Term Care — and pretending the two aren’t directly connected?

Regardless of your advisory role or client relationship, you must accept the reality that retirement and healthcare are financially inseparable.....FULL STOP!

Every model of retirement income, liquidity, or longevity risk assumes linear spending even though healthcare costs are nonlinear

shocks, distorting asset allocation, disrupting cash flow, and accelerating portfolio drawdown at the worst possible time. Attempting to isolate healthcare and LTC as “insurance topics” will be a failed attempt to decouple the very risks that drive retirement failure.

The consumer who diligently or methodically plans for a sequence of returns, inflation, and longevity will still be unprepared for the one event that triggers all three at once. Until healthcare and LTC are integrated into every retirement income model, Monte Carlo simulation, and decumulation strategy, the question isn’t whether clients will run out of money — it’s when they’ll realize their plan was built on the wrong assumptions.

21. Why does Long-Term Care Awareness Month start the day after Halloween?

Because the industry’s been scared of the topic for decades. For years, the advisory community has treated healthcare in retirement and LTC like the monster under the bed — everyone knows it’s there, no one wants to look. They run stress tests for market downturns, write trusts for death, construct plans for living too long — but freeze when the conversation turns to what happens when the longevity curve bends south. It’s not a lack of data — it’s a fear of reality.

The irony? The longer we hide from it, the more powerful it becomes, as every unaddressed care need, every unmodeled health event, every family left to self-fund turns the unknown into a nightmare. So yes, LTC Awareness Month begins the day after Halloween — because it’s time to stop being scared of the topic and start planning for the real-life horror story waiting for millions of Americans.