Barry Bucks: The Recently Divorced Grandfather

Even the best financial plans require occasional updates, and a life-changing event like divorce later in life could certainly necessitate some tweaking! In this case study, we make the following planning assumptions:

- Sam, age 58, is a recently divorced father/grandparent.

- He has substantial assets and plans to retire at 65.

- Sam is concerned about becoming a burden on his three children.

- His children are the beneficiaries of the current life insurance policy death benefit, which is now a secondary concern to LTC.

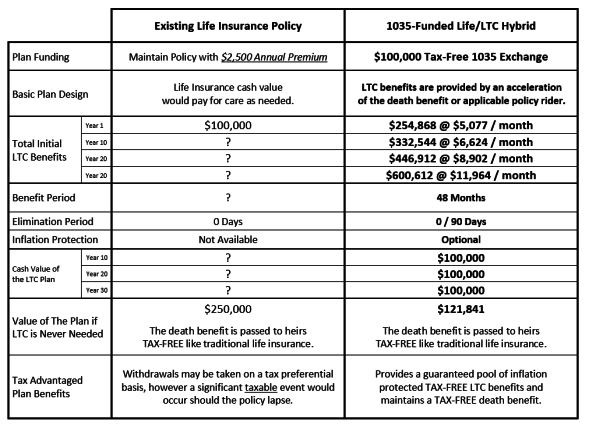

- The policy has a $250,000 death benefit, a $2,500 annual premium, and a cost basis of $50,000.

- He would “pay for care” with $100,000 of cash value in a Variable Universal Life Insurance policy purchased more than 20 years ago.

- His HALO Assessment projects a four-year, $5,000/month need for care.

If Barry were your client and he was concerned about Long-Term Care, which scenario would you recommend?

By reallocating the cash value of a life insurance policy that is no longer needed, it's possible to create a substantial Long-Term Care Plan with a variety of tax-free benefits, and in this case, it's better than ZERO out-of-pocket because you're helping him save $2,500/year.

211011