Sally Saver: When Can I Stop Paying for My Plan?

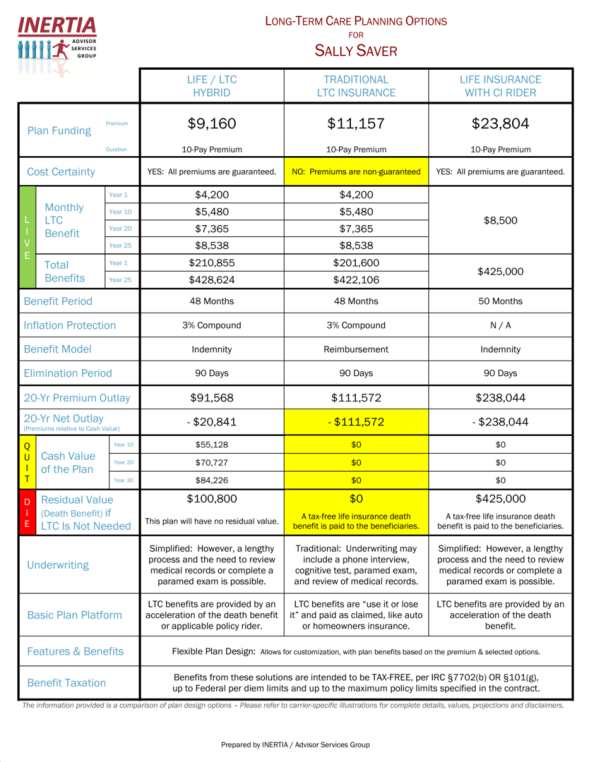

Planning for future Long-Term Care (LTC) expenses will often include the desire to expend a finite amount of resources. So, even if a client's assets are insufficient to fund the plan with a single-premium, there are a number of plan design options to consider.

In this case study, we make the following planning assumptions:

-

Sally is 60 years old and is recently divorced.

-

She has approximately $500,000 in assets, primarily home equity, in lieu of a portion of her ex-husband's retirement accounts.

-

She will receive $5,000/month in alimony from her ex-husband until age 70, when she can take the maximum Social Security benefit. The alimony will far exceed what's necessary to maintain her lifestyle.

-

Her Long-Term Care "Plan" would be to tap that alimony for the next 10 years, but unsure if she wants to tap home equity after that.

-

A HALO Assessment projects a four-year, $4,200/month care need.

If Sally was your client, which of the LTC Planning solutions would you recommend to maximize her funding sources and address her comprehensive planning goals?

And....Does your current LTC wholesaling resource provide a presentation tool like this?