Nick & Nancy Newlywed: The Power of the Pension Protection Act

Long-Term Care (LTC) Planning for Couples may have unique variables to consider, particularly those in a 2nd marriage. One factor to consider is that without proper planning, one of the individuals has a high likelihood of becoming a caregiver and/or will survive the spouse who requires care. A second factor may be that one of the individuals may want certain assets to pass on to specific heirs...

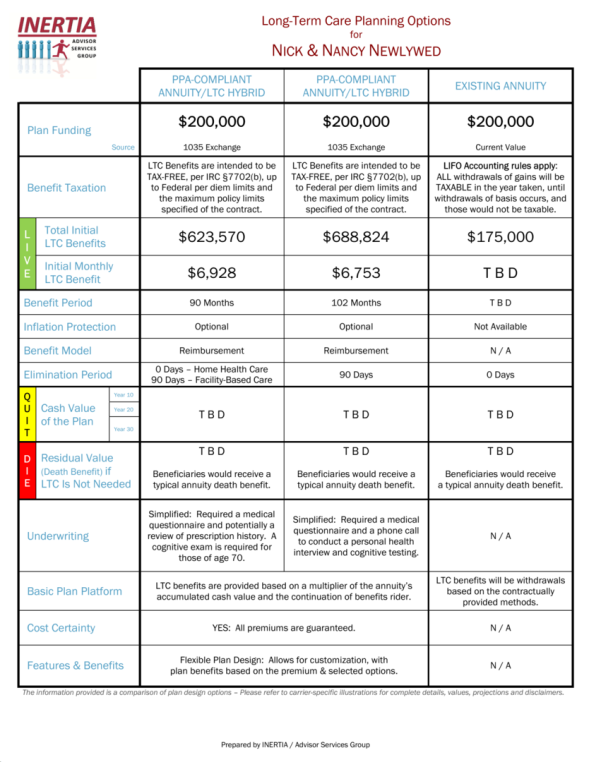

For this case study, we make the following planning assumptions:

- Nick & Nancy, both are age 65

- Recently married (2nd marriage each)

- Both have assets and plan to retire this year.

- They would “pay for care” with $200,000 in Nancy's existing annuity, which has a $100,000 Cost Basis.

- Concerned about becoming a burden on one another and their families.

- They were unaware of the Pension Protection Act (PPA) and how to leverage it and turn Nancy's single-life annuity into a joint-life LTC Plan.

* Some traditional LTCi carriers may accept a 1035 exchange to fund an individual policy; however, no carrier will

facilitate a 1035 exchange to fund a joint plan, as that requires separate contracts and violates the 1035 rules.

Which LTC Planning option would you recommend to achieve their goals and maximize the existing annuity?

And....Does your current LTC wholesaling resource provide a presentation tool like this?

By planning ahead, your clients can upgrade an existing annuity (1035 Exchange) to a PPA-compliant LTC Annuity TAX-FREE and then, when necessary, take TAX-FREE withdrawals from the new annuity to cover qualifying Long-Term Care expenses in the future. All with ZERO out-of-pocket cost!

230807