The Case for Alternatives To Long-Term Care Insurance

"Facts are stubborn things; and whatever may be our wishes, our inclinations, or the dictates of our passions, they cannot alter the state of facts and evidence".

John Adams, U.S. President (1797-1801)

If President Adams was correct about "facts," then perhaps it’s time to change the discussion regarding the Long-Term Care (LTC) Planning market and better understand why it has changed. One can argue the merits of LTC insurance or why it may be the right or wrong solution for clients, but it's no longer productive to go down that path. As financial services professionals, advisors, and fiduciaries, we should be having planning-oriented discussions to encourage clients to proactively address Healthcare in Retirement. PERIOD!

All too often, discussions about LTC planning and solutions descend into obnoxious Twitter rants to prove who's right or wrong.....or why anything besides LTC insurance is evil..... or how using the words "always", "never" and "must" in an article somehow makes it gospel.

With respect to those who truly feel or believe an LTC plan begins and ends with traditional LTC insurance, they are certainly entitled to those feelings and beliefs.....They are not, however, entitled to their own set of facts. As we head into 2018, it is simply impossible to deny the inertia of today's MARKET and the facts (graphic below) about LTC planning solutions, as reported recently by LIMRA.

Here are some of the highlights....

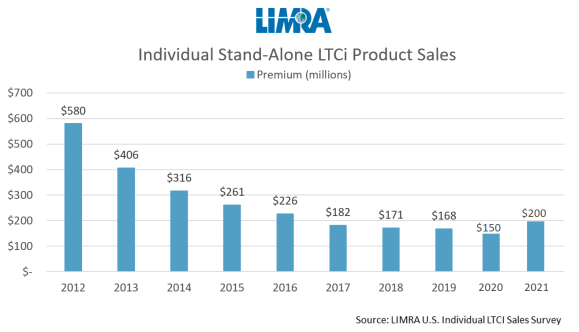

- The total annual premiums for LTC insurance sales have declined 60 percent since 2012.

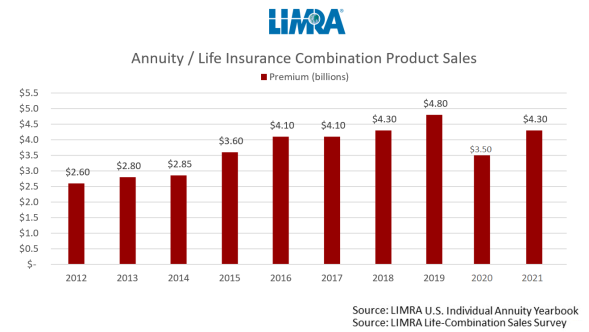

- 94% of the total $4.3 Billion in premiums for the LTC planning market are going into alternatives to traditional LTC insurance.

- Sales of the Annuity/LTCI combination products have increased consistently since 2011.

These are facts; not feelings or beliefs. For some, that can be unsettling as they may not be able to understand why the market may be turning their belief system upside down.....

The Evolution of Long-Term Care Planning.....

There are numerous reasons why the market has turned on LTC insurance as a planning tool, but it's probably best to explain the situation in terms of "Occam's Razor, the principle established by the logician William of Ockham in the 14th century, whose theory states that one should not make unnecessary assumptions and that the answer to a problem is often the simplest."

The market is and has been moving away from traditional LTC insurance because it's bad math!

1) It won't happen to me!!

When we cite studies indicating a certain percentage of Americans will need LTC as they age, the vast majority of prospects/clients will say they will be in the other percentage of people won't need LTC.

For these people, the math doesn't add up.....

2) Zero + Zero + Zero = Zero

Even consumers who see value in planning for Healthcare in Retirement and LTC usually won't overlook the three primary objections to traditional LTC insurance. They don't want to spend money on an insurance product with ZERO cash value, ZERO residual value, and ZERO cost certainty. For these people as well, the math just doesn't add up.....

So, quite simply, an LTC Plan design using Life Insurance or Annuities will (1) allow validation for the client who "won't need care" or (2) provide guaranteed cash accumulation, guaranteed residual value (death benefit), and guaranteed premiums; thus the simple math works out for the majority of clients and prospects!!

Now, for those who still want to argue their feelings & beliefs about LTC insurance, it's important to understand that the market just doesn't care!! No more than the market cared about those who felt Betamax was a better standard than VHS, or Netscape was a better browser than Explorer, and on and on because an efficient market chooses the winners and losers, no matter how many feelings or beliefs are run over in the process.

Assuming you now have a better understanding of LTC Planning, below are some ways to become even more familiar with the concept of using life insurance and annuities in a LTC plan....

1) Make it an Asset, Not an Expense!!

2) Using Life Insurance For Long-Term Care Planning

3) Layered Long-Term Care Planning

4) Insurance Reviews & Retirement Planning

5) Life Settlements & Long-Term Care Planning

6) The Power of The Pension Protection Act

Please contact us to discuss LTC Planning opportunities for your clients....