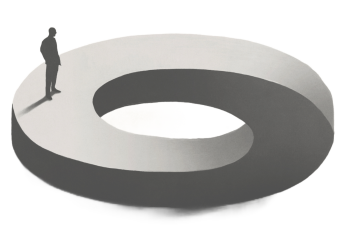

The Impossibility of Quantifying The Physical & Emotional Costs Associated With A Self-Funding Strategy for Long-Term Care….

Long-Term Care (LTC) Planning is crucial to ensuring a comfortable and secure future as your clients age, and it involves addressing the Medicare-excluded care needs that come with the inability to perform certain activities of daily living or other needs that may arise in one's life. Unfortunately, surveys indicate less than 20% of Americans have LTC Planning in place1, while the rest employ a self-funding strategy (usually by default), where your clients must rely on personal resources and assets to cover these expenses.

While this approach may seem practical, the physical and emotional cost on a client's spouse, partner, or loved ones cannot be accounted for, much less calculated. So, before deploying or implementing a self-funding strategy for LTC Planning, you should encourage your clients to consider the following…..

Physical Costs On Loved Ones

1) Caregiver stress and burnout are two significant physical tolls of a self-funding strategy for LTC. Clients often underestimate the burden experienced by a spouse or family members who feel obligated to be the primary caregiver or become responsible for managing care services, providers, or facilities for a loved one. Not only can it be physically demanding, but Caregivers face challenges managing their jobs, families, and personal lives to provide or facilitate care for a loved one, leading to chronic stress and burnout.

2) There is a disruption of everyday life when a loved one takes on the role of a caregiver, and their personal routines and daily activities are significantly disrupted. Balancing caregiving responsibilities with work, household chores, and personal obligations can become overwhelming, impacting their overall well-being. The physical toll of constant care provision can result in fatigue, sleep deprivation, and ultimately, health issues and concerns for the care provider.

3) Assuming the financial strain of a self-funding strategy will be manageable for your client's LTC doesn't account for the considerable financial strain that can impact loved ones. This is especially true for loved ones left out of the decision to implement a self-funding strategy or when the self-funding strategy fails due to depleted savings or assets. Your client's loved ones are forced to pick up the pieces and must then incur costs associated with medical care, home modifications, specialized equipment, and other necessary expenses until suitable Medicaid-funded care can be obtained.

Emotional Costs on Loved Ones

1) The guilt and anxiety loved ones grapple with go into the "unintended consequences" column when employing a self-funding strategy for LTC. They may feel guilty for not being able to personally provide the care Mom or Dad deserves, or worry about making the right choices that lead to being judged by other family members. These emotions can have a profound and lasting impact on their mental health.

2) It is emotionally draining to witness a loved one's physical or cognitive decline, and managing the challenges that come with it can be emotionally draining. The strain of witnessing a decline in a family member's health and dealing with the associated emotions can lead to depression, anxiety, and feelings of helplessness.

3) Strained relationships are a direct and unquantifiable cost associated with a self-funding strategy. The stress and emotional toll of caregiving and the financial burden within a family lead to disagreements and resentment between family members on care decisions, financial responsibilities, and coping with the emotions of seeing a loved one struggle.

Advisors across the financial services spectrum can easily articulate every reason clients need their retirement, estate, financial, or tax planning expertise. All the while, so few will have an honest discussion about the impossibility of quantifying the physical and emotional costs associated with a self-funding strategy for Long-Term Care Planning......

Regardless of your advisory role, clients need your guidance to explore LTC Planning options that can help alleviate the physical and emotional burdens their family members will otherwise be saddled with.

1 OneAmerica LTC Consumer Survey, March 2022, https://www.oneamerica.com/campaigns/survey/ltcsurvey

20251021