Yes, Actually, Long-Term Care Planning is Your Job!

As a dedicated member of the advisory community, your mission is to guide your clients toward achieving their financial and personal goals. However, according to surveys by OneAmerica/Hanover Research (March 2022) and the Nationwide Retirement Institute/LIMRA (May 2023), less than 20% of Americans having a plan for Long-Term Care (LTC), it's clear that far too many in the advisory community overlook this critical aspect of their clients' futures. You can try to put LTC Planning outside your advisory focus, but that won't change the reality that integrating it into your practice is essential for providing truly comprehensive, future-focused advice.

Here's why LTC Planning is your responsibility—and how to overcome the most common objections you might face.

Financial Advisors or Planners: Enhancing Financial Security

Objection: LTC Planning is complex and diverts time and focus from primary financial planning goals.

Solution: LTC Planning should be a vital component of a robust financial strategy. By preparing for potential care needs, you help clients safeguard their assets, ensure their financial goals remain intact, and minimize the impact of a LTC event on their loved ones.

Estate Planning Attorneys: Protecting the Legacy

Objection: LTC Planning may complicate already complex and confusing estate planning.

Solution: Incorporating LTC Planning into estate strategies helps protect clients' assets from being depleted by care costs, ensuring they have the appropriate legal framework to maintain choice and preserve their legacy for future generations.

Elder Law Attorneys: Proactive Planning Prevents Crises

Objection: Immediate legal concerns like Medicaid qualification or guardianship often take precedence over Long-Term Care (LTC) Planning.

Solution: Proactive LTC Planning is a strategic extension of Medicaid and guardianship planning, helping clients avoid crisis-driven decisions. By integrating LTC strategies early, you empower clients—especially couples—with greater control over their care options and financial resources, ensuring a more stable and predictable future.

CPA and Tax Professionals: The Unbreakable Link Between Taxation and Healthcare/LTC

Objection: Long-Term Care (LTC) Planning is not within my purview of tax planning or completing tax returns.

Solution: LTC Planning enhances financial outcomes when strategically integrated into comprehensive tax planning. Whether through tax-deductible, tax-advantaged, tax-deferred, or tax-free strategies, your guidance is crucial in helping clients leverage the tax code for their LTC needs, making LTC Planning an essential component of effective tax management as they prepare for future care costs.

Medicare Specialists: Filling the Coverage Gaps

Objection: Clients only want to address Medicare Supplement or MedAdvatage and what those cover.

Solution: The Medicare "Coverage Gap" for LTC is a reality, and you should educate clients on the limitations of Medicare and encourage appropriate LTC Planning to ensure they are financially prepared for that coverage gap. Regardless of your client's financial means, proper planning will help them access the care they need when they need it.

Health Insurance & Employee Benefit Specialists: Ensuring Healthcare Security Though Working Years

Objection: Clients often believe that their health insurance or employee benefits sufficiently cover their future healthcare and LTC needs.

Solution: While health insurance and employee benefits provide essential coverage, there is a significant gap from chronic illness for LTC, so educating employers and employees on these limitations is crucial. By encouraging the integration of LTC Planning into your employee benefits offerings or health insurance consultations, you ensure that clients are fully prepared for potential care costs. This proactive approach enhances the value of your services and empowers clients to make informed decisions about their future healthcare and protect them from the financial strain that LTC can impose.

Risk Management Professionals: More Than Just Insurance

Objection: Clients may perceive additional insurance products as unnecessary or burdensome.

Solution: LTC Planning transcends the sale of insurance; it's about developing a comprehensive risk management strategy that aligns with a client's unique needs and risk tolerance. This approach may involve a balanced mix of self-funding, insurance, and other financial tools, offering clients greater control and peace of mind. Focusing on a holistic strategy enhances your role as a trusted risk manager, helping clients protect their future without feeling pressured into buying more insurance.

Family Offices and Wealth Managers: Protecting and Preserving Wealth

Objection: The affluent and high-net-worth don't believe they need LTC Planning.

Solution: Even the wealthiest client will benefit significantly from LTC Planning. Beyond protecting and preserving their wealth, LTC Planning provides the convenience of ensuring that their assets are strategically positioned to cover care costs without undermining their legacy goals. By incorporating advanced strategies like the Look-Alike Roth IRA, you can help clients efficiently manage their resources, ensuring their wealth continues to serve their long-term objectives rather than being unexpectedly drained by care expenses.

Trust Officers: Simplifying Trust Administration

Objection: Long-Term Care (LTC) Planning may be viewed as less critical when the primary focus is on managing complex trust arrangements and ensuring fiduciary compliance.

Solution: Elevate LTC Planning by framing it as integral to the trust professional's mission. Proactively incorporating LTC strategies ensures the trust safeguards wealth and upholds the client's care preferences and long-term well-being. This approach aligns trust administration with the client's intent, enhancing the trust's purpose and fiduciary responsibility.

Retirement Plan Advisors: Securing Retirement Income

Objection: Clients are already focused on accumulating enough for retirement and may see LTC Planning as an

additional burden that diverts resources from their primary retirement goals.

Solution: Position LTC Planning as a critical component of a comprehensive retirement strategy. By integrating LTC Planning into the retirement plan, you help ensure that clients' retirement savings are protected from the potentially devastating costs of long-term care. This approach secures their retirement income and provides peace of mind, knowing that their future care needs are accounted for without jeopardizing their lifestyle or financial security.

Senior Healthcare Professionals: Coordinating Care Today.....and Tomorrow

Objection: LTC Planning falls outside the primary focus on current care needs for an aging loved one.

Solution: While your priority is securing care for the aging loved one in seat #1, an adult child often sitting in seat #2 will eventually face similar care needs. Become a trusted resource and collaborate with LTC Planning specialists to encourage proper planning and a more secure future when for the next generation, as this is your opportunity to take the initiative to ensure that the adult child has a proactive LTC Plan in place for their future, where they will occupy seat #1 and their adult child will be in seat #2.

It's All About Comprehensive Planning! Long-Term Care Planning isn't just an optional add-on; it's a critical aspect of your comprehensive advice to your clients. By integrating LTC Planning into your practice, you're helping clients secure their financial future, protect their assets, and ensure they receive the care they need when needed.

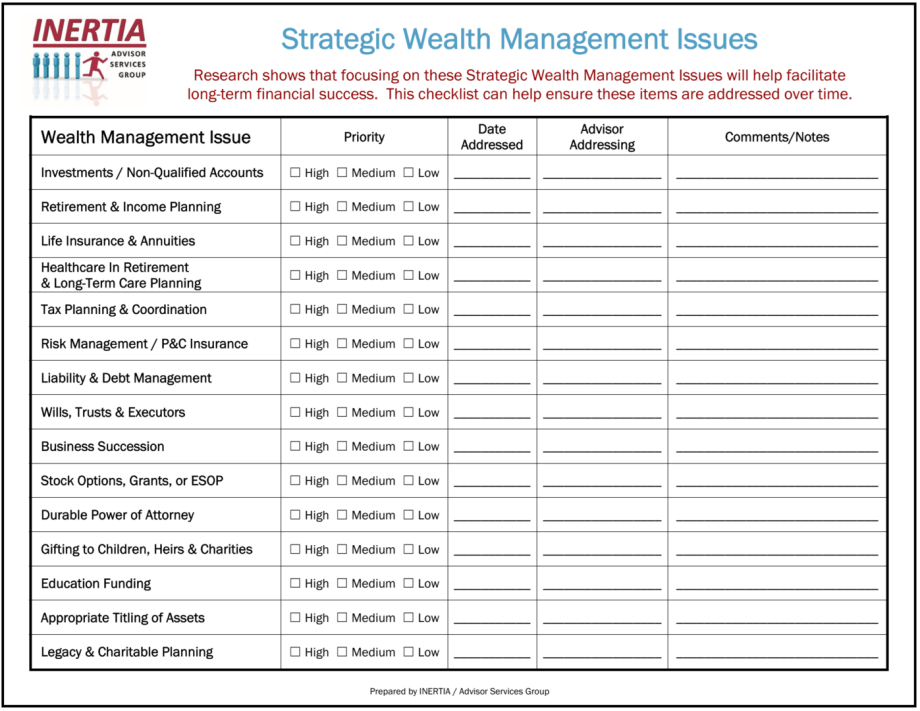

So yes, Long-Term Care Planning is your job, and you can download the "Strategic Wealth Management Issues" Worksheet below to prioritize it based on your advisory role....

Adobe Acrobat document [127.7 KB]