Understanding Why Longevity Is Crushing The American Safety Net

There's plenty of uncertainty surrounding the future of Social Security and Medicare, and many places to lay the blame for that uncertainty. However, the real culprit here and the real blame lies with the American people. Indirectly anyway, as we just keep living longer taxing a poorly designed "safety net" unprepared for a growing, aging population.....

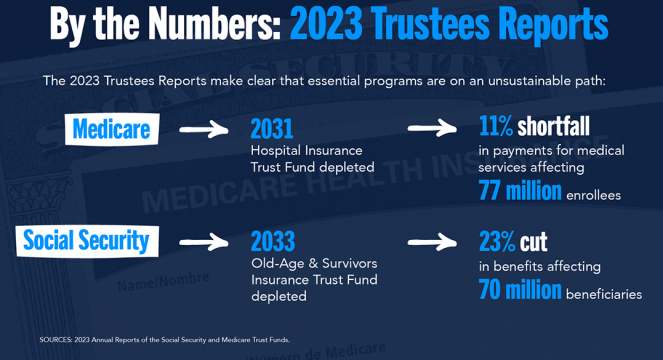

While the graphic above screams uncertainty, it's important to understand how we got here.....

- When the Declaration of Independence was signed a little more than 240 years ago, the signers of that document were lucky to live beyond the age of 36.

- Less than 100 years later, at the end of the Civil War in 1865, life expectancy had grown to age 42....

- When Social Security was created in 1935, life expectancy had risen to about 62, so essentially, we created a plan to help.....dead people.

- Lastly, President Johnson signed Medicare legislation in 1965 when life expectancy was about 68, and there were just 10M Americans of Medicare eligibility age.....yet today, life expectancy is now pushing 80, and we now have more than 55,000,000 Americans on Medicare and/or Social Security.

Regardless of one's political leanings, looking at Longevity makes it easier to see how our country will have difficulty maintaining Medicare and Social Security in their current form. These programs - quite simply - were never designed to do what they're being expected to do today. Without at least addressing life expectancy, it's likely that any "fix" just kicks the can down the road.....America's "Safety Net" programs are being crushed under the weight of Longevity, and I don't think there's a politically expedient way to correct that!!

Understanding Longevity, even in its simplest form, will almost certainly help you engage clients about Healthcare In Retirement and the need for Long-Term Care Planning.

231006