Understanding Medicare: A Prerequisite for Retirement Planning

As Boomers continue heading into or towards retirement, it's really surprising how many of them actually understand so little about Medicare. Even more surprising is how so many of them create retirement and financial plans while failing to recognize how and why healthcare costs may impact all of that planning. Perhaps it would be helpful to look back and determine how we got here....

On July 30, 1965, President Lyndon Johnson signed Medicare into law, creating a massive new program that failed to account for some basic economic or actuarial principles. Primarily, in 1965, life expectancy was about 68 years, so his Medicare program was essentially designed to cover retiree medical costs, on average, for approximately three years.

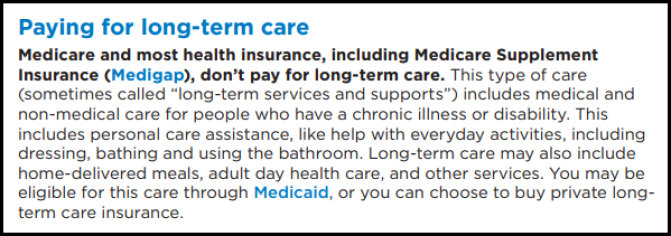

However, today's life expectancy is approaching age 80, and the program initially providing medical coverage for just 10 million Americans will soon cover more than 75 million, so the growth of the 65+ demographic exposes the insurance plan's significant design flaw. That growing demographic and their lack of understanding about Medicare leads to another significant concern, as Medicare excludes coverage for one of the most utilized and expensive forms of Healthcare In Retirement: Long-Term Care

Do yourself a favor and click on the Medicare graphic to the upper left to download a copy of the Medicare & You handbook because when it comes to planning for Healthcare In Retirement, the majority of Americans over age 50, according to AARP, are unaware of what Medicare says on its website or what can be found on page 56 of Medicare & You in the graphic below....

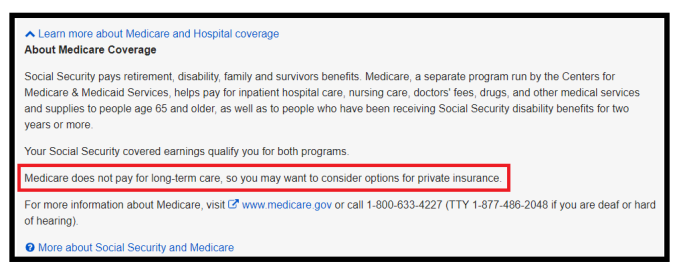

Another way to ensure clients understand Medicare is to explain how Social Security (SSA) is essentially linked to Medicare as a program for retirees, and SSA makes it clear that planning for Long-Term Care needs is the individual's responsibility. Due to cost-cutting measures, Social Security Statements are no longer mailed to Americans annually. However, the data is still available, and you should instruct or show clients how to visit the Social Security website and set up an account. Once the registration process is complete, review the personalized landing page and projections, then simply scroll to the bottom of the see the image below:

ALL clients concerned about or engaged in retirement planning should utilize SSA.gov, as that's the ONLY way to obtain accurate input data for their expected Social Security payments. Furthermore, it's critical to recognize that Social Security and Medicare are linked in retirement, and your advisory relationships will be enhanced by helping your clients understand Medicare and how it fits into the comprehensive planning you're working so hard to implement.

It's vital to address "Healthcare in Retirement" in a client's financial planning, and we look forward to assisting you in implementing their Long-Term Care component.

20250416