Top Misconceptions About Long-Term Care

There are many myths surrounding Long-Term Care Planning, so it's easy to understand why consumers typically make poor choices in this area. Hopefully, after reviewing our Top-5 Long-Term Care planning myths below, you and your clients will have a better perspective going forward.

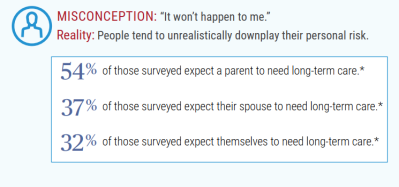

I won't need Long-Term Care....

Based on statistical data from the Federal government, about 60% of those over age 65 will require some form of Long-Term Care service during their life; so it's a mistake to assume your clients can ignore this topic. Americans manage risk based on the probability of a particular event occurring and impacting a family and its finances. This is why it's very important to consider the probability of events not just today but as we age and when Long-Term Care will be necessary.

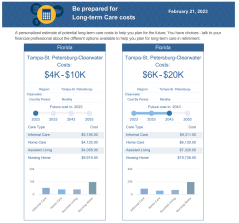

Long-Term Care Plans only cover nursing homes...

Most consumers don't realize that only 20% of Long-Term Care is provided in a Nursing Home, and the primary goal of a Long-Term Care plan is to ensure there are choices as to how and where care is received. Today, most Long-Term Care services are provided in the home, a community-based setting, or an Assisted Living Facility. When remaining at home is no longer an option, a Long-Term Care plan ensures more choice in nursing home selection or location.

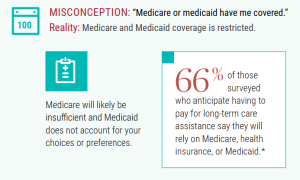

I have Medicare/Health Insurance, so I'm set...

Health insurance covers the costs associated with an illness or injury, such as prescriptions and doctor/hospital visits. Even the most extensive health insurance plans exclude coverage for chronic illnesses, those that limit one's activities of daily living. Medicare has extremely limited coverage for Long-Term Care, usually limited to 100 days associated with skilled or rehabilitative care after another covered event. Simply put, a Long-Term Care plan is to cover chronic or age-related conditions not covered by Medicare or health insurance.

I can wait until I’m older to do Long-Term Care Planning...

The best time to implement a Long-Term Care plan is before a physical or mental condition is diagnosed, conditions which will lead Americans to require assistance in accomplishing daily activities such as eating, bathing, dressing, and medicating themselves. Generally, it's less expensive to implement a Long-Term Care plan at a younger age, so waiting can be a big mistake. Additionally, the cost of implementing a Long-Term Care plan may be impacted by health issues associated with aging.

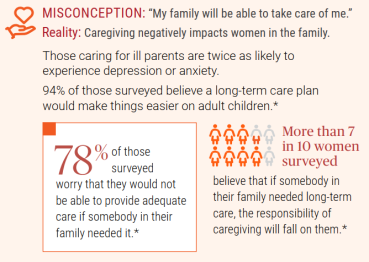

My Family will take care of me...

Reality check.....Have your clients actually ASKED their family if they want to or will take care of them? What happens if they move to another city or pass away, or their job/career makes it impossible? Becoming a Caregiver or expecting a family member to provide care should not be taken lightly. Some additional perspectives on the topic can be found here:

There Are No "Snow Days" for Caregivers.....

Helping Aging Neighbors During The Holidays

A Long-Term Care plan is only beneficial if I get sick...

With the evolution of financial planning overall, there are a number of ways to implement a Long-Term Care plan where benefits are guaranteed to be available in a variety of ways. There are pros & cons to every planning solution, so the key is to implement a customized plan that compliments other planning in place or being considered.

Help your clients get past the myths and confusion to better understand the need for LTC Planning.....

* VerstaResearch, “2020 LTC Marketing and Thought Leadership Research, Findings from Surveys of Advisors and Consumers,” October 2020.

221027