The Moment EVERY Client’s Financial Future Demanded A LTC Plan

You might not realize it, but a pivotal moment established the need for EVERY client to begin planning for Long-Term Care (LTC). It wasn't when a parent or grandparent needed care—it was much earlier, often before they realized it……when they received their first paycheck and withholding! Every American unknowingly sets a course toward planning for retirement and their healthcare needs in retirement, but few understand where that path actually leads. It's time for the advisory community to help consumers connect the dots and ensure that the safety net of health coverage doesn't unravel when LTC becomes a reality.

The Financial Lifecycle: From Income to LTC Planning

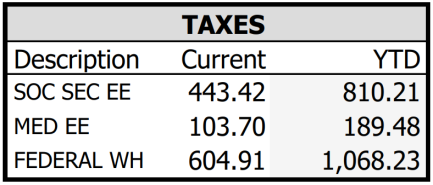

Income = FICA: The journey begins with that first paycheck. Each pay stub shows FICA deductions, setting up future benefits through Social Security and Medicare. These deductions instill a sense of proactive planning—clients believe they are preparing for retirement and healthcare in their golden years.

Youth and Early Adulthood = Overlooking Insurable Risks: During their younger years, most clients are focused on immediate financial needs and aspirations—education, career growth, and starting families. At this stage, insurable risks like disability, critical illness, or future long-term care needs are rarely considered, often because they seem distant, unaffordable, or unnecessary. Overlooking those insurable risks creates a critical planning gap that becomes a ticking time bomb as life progresses.

Health Insurance = The False Sense of Security: Clients contribute to health insurance throughout their working years, often through payroll deductions, reinforcing the belief that healthcare needs are covered. Even so, there's a dangerous assumption that includes future LTC needs when, in reality, health insurance excludes LTC.

Medicare = LTC Reality: As clients "age into" Medicare, they realize that most of their healthcare needs are covered, with one of the significant exclusions being LTC. Unfortunately, 45% of Americans (and perhaps many in the advisory community) haven't done the basic research to understand Medicare's limitations.

The "Uh-Oh" Moment: That is the day every client's need for LTC planning truly begins. It might be prompted by a personal health event, a family situation, or witnessing a friend struggle with their Activities of Daily Living and need care. At this point, the gap between perceived and actual coverage is undeniable.

The Consequence of No Plan: Without proper LTC Planning, clients and their loved ones face financial, emotional, and logistical consequences. When LTC needs arise, families often face gut-wrenching decisions under extreme stress. Advisors who acknowledge this reality and act decisively will protect their clients and reinforce their role as trusted, indispensable professionals—those who do more than the default and genuinely plan.

It's time for the advisory community to elevate their conversations around LTC. Start by asking clients when they began planning for healthcare in retirement. Challenge assumptions about what health insurance and Medicare cover. Guide them toward solutions that bridge the gap between a lifetime of payroll deductions and the real-world costs of care. Americans need to recognize that the need for LTC Planning begins when they receive their first paycheck…..long before care will be necessary.

Advisors who acknowledge this reality will solidify their role as indispensable professionals.

20250303