“TBD” Is Not An Acceptable Funding Source for Long-Term Care

Whether the advisory community wants to admit it or not, every American already has a Long-Term Care (LTC) plan. The only question is whether it's proactive — structured to avoid chaos and crisis — or whether the consumers' needs are ignored in favor of the excuses: "it's not my job," "I just manage the investments," or "someone else will handle it." They can argue as loudly as they want, they can come up with more weak excuses, and even cop out and say their clients are all self-funding their future LTC needs. The more they do, the clearer it becomes that THEIR clients are the stats in the surveys and studies, and part of the less than 20% of Americans who have addressed this topic in their planning.

Unfortunately, most of the advisory community fails to engage consumers and answer even the most basic questions about PLANNING FOR future care needs. Instead, they arrogantly leap ahead to PAYING FOR care — and even then, most can't get that right. Here's the simple truth: if there's no clarity about where the dollars are coming from, there is no LTC plan — only wishful thinking. The funding source isn't a footnote — it dictates structure, tax treatment, sustainability, and when appropriate, insurance strategies for consideration. Recognizing the source is essential for creating tailored, effective LTC planning, and when appropriate, aligning the funding source with specific insurance-based LTC planning solutions to enhance the plan's effectiveness and sustainability to maximize tax code leverage or asset protection strategies.

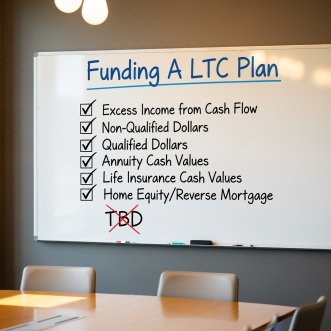

Plan funding for consumers can only be leveraged by one of these six funding sources for their LTC needs: excess income from cash flow, non-qualified dollars, qualified dollars, annuity cash values, life insurance cash values, and home equity/reverse mortgage……each offering unique pros and cons to achieve planning goals.

Excess Income from Cash Flow: For clients with a steady, substantial income stream, allocating excess cash flow can be an efficient way to fund an LTC plan. This approach offers flexibility and control without tapping savings or assets. Regular income can support premiums for a range of insurance-based solutions — from traditional LTC insurance to recurring premium hybrid life policies — tailored to planning needs, while providing peace of mind and ensuring multi-generational financial security.

That said, there needs to be a reality check: relying on cash flow alone is illogical because it provides no leverage. Consider every other insurable risk — no one "self-funds" their home, their cars, or their businesses. Why should LTC be different? Equally importantly, when a care plan involves private-pay providers or preferred facilities, many may soon require verification of benefits from an insurer before admitting a patient, so "I can afford it" won't matter when documented, pre-approved coverage is necessary.

Non-Qualified Dollars: These funds were already taxed — savings accounts, brokerage accounts, or other liquid assets. Leveraging these dollars for LTC planning provides immediate liquidity and flexibility, which can be especially useful for clients who have accumulated significant assets outside of retirement accounts.

However, most N/Q assets sit in bank or investment accounts exposed to capital gains, dividends, and interest taxation. Using those dollars directly for care creates a hidden tax drag — essentially making every $1 of care cost $1.20 or more. Add in the reality of market volatility, and the risk compounds: if care begins during a market downturn, liquidation at depressed values further magnifies the loss.

By contrast, repositioning some of those dollars into properly designed insurance-based solutions — such as hybrids or PPA-compliant annuities — can convert taxable growth into tax-free LTC benefits, insulate dollars from market risk, and ensure assets are leveraged rather than just spent down.

Qualified Dollars: These are funds in tax-advantaged retirement accounts such as IRAs, 401(k)s, or other "pre-tax" retirement plans. For many consumers, these accounts represent one of the largest pools of assets available, making them a substantial resource for LTC planning. However, strategic planning is essential because every distribution from a qualified account is taxable — there's no way around it. Using qualified dollars directly for care can inflate taxable income, push clients into higher brackets, and even trigger Medicare IRMAA surcharges. In real terms, a $1 care expense may require $1.30 or more in withdrawals once both the cost and tax impact are factored in.

Relying on qualified accounts as the "default" LTC funding source is risky. Timing matters — if care begins during a market downturn, clients may be forced to sell depressed assets to cover distributions. On top of that, Required Minimum Distributions (RMDs) must still be taken, whether care is needed or not, which can compound tax exposure and reduce flexibility.

And here's the bigger issue: if qualified dollars are earmarked as the future LTC funding source, failing to reposition at least some of those assets into an insurance-based structure represents a significant opportunity cost. Without that leverage, every dollar is at risk of being spent down inefficiently, instead of being multiplied into tax-free LTC benefits or leaving residual value for heirs. Pairing qualified dollars with insurance-based structures ensures predictability, leverage, and protection from both tax drag and market risk.

Annuities & Annuity Cash Values: Annuities are often used as a reliable supplement for retirement and income planning, and — regardless of who hates annuities — they are also becoming an attractive funding source for LTC planning. They have two distinct phases: a tax-deferred accumulation phase and a taxable payout phase. The predictability of both can make them a practical source of plan funding. During the payout phase, that income can cover premiums for either traditional LTC policies or recurring-premium hybrid life solutions.

The bonus, though, comes in the distribution phase and Pension Protection Act (PPA) compliant solutions. If an existing non-qualified annuity is no longer needed for retirement income, it can be repositioned through a 1035 Exchange into a PPA-compliant LTC annuity. That move doesn't just preserve tax deferral — it converts taxable gains into tax-free LTC benefits.

Assuming a client's annuity is the designated pay for source for future care needs, the failure then to understand and recommend this upgrade borders on negligence for the following reason: Leaving gains in a taxable annuity and then recommending "self-funding" care is counterproductive and perhaps the least efficient LTC funding strategy for a client. Whether from the client, advisory community, compliance, or regulator perspective, it should be unacceptable to position a client to pay an after-tax cost of $1.20–$1.30 for every $1 of care when it could cost pennies on the dollar! Furthermore, excuses — whether it's not being insurance licensed, a disdain for a product, or avoiding the review of client annuities — are irrelevant when repositioning old annuities into a PPA-compliant structure can create tax-free LTC benefits rather than simply draining a taxable asset.

Life Insurance Cash Values: Life insurance policies with accumulated cash value can be an effective funding source for LTC planning. Permanent policies naturally build cash value over time, and those dollars can be tapped through loans or withdrawals to offset care costs. This approach lets clients leverage their policy while still preserving a death benefit for beneficiaries — but unmanaged withdrawals risk lapsing the policy entirely. The truth is that as clients age, the need for a significant life insurance death benefit often diminishes, while the risk of LTC needs rises. At that point, the cash value locked inside a policy may be far more valuable as fuel for an LTC plan than as a slowly eroding death benefit.

If paying for LTC is the primary objective for these dollars, repositioning through a 1035 Exchange is often a wise decision. Unlike annuities, life insurance can be reallocated into multiple structures: a hybrid life/LTC policy, a life policy with an LTC or chronic illness rider, or even an annuity hybrid. That flexibility matters because rising mortality charges can reduce efficiency as consumers age — meaning hybrids on a life chassis aren't always the best fit. In those cases, reviewing both life- and annuity-based options becomes essential to identify where the client gets the most leverage with the least drag, while weighing features like Return of Premium, inflation protection riders, or continuation of benefit riders.

If an old life policy is sitting with idle cash value and an advisor fails to explore how to maximize or create tax-advantaged LTC leverage, that's not planning — it's not best interest, not KYC, and not fiduciary behavior. At a minimum, clients deserve to know when repositioning can transform stagnant cash value into meaningful, tax-efficient LTC protection.

Home Equity/Reverse Mortgage: For many Americans, home equity is their largest untapped asset. A Home Equity Conversion Mortgage (HECM) — more commonly called a reverse mortgage — allows homeowners to unlock that value tax-free without selling the property. For clients whose wealth is tied up in their home, a HECM can be a substantial funding source for LTC planning. It also preserves the option to remain in their residence while still generating the cash flow needed to cover rising care costs.

When structured properly, those tax-free proceeds can be directed toward LTC premiums, making insurance-based solutions affordable and sustainable. The real advantage comes when HECM funds are paired with Partnership Qualified LTC insurance. This pairing doesn't just buy coverage; it shields an equal amount of assets from Medicaid spend-down, creating a true dual-protection strategy.

LTC planning aside, the advisory community often ignores home equity in the broader financial planning conversation. For many Americans, it's the single largest asset they own — yet it's rarely integrated into retirement income, legacy, or risk management strategies. Pretending it doesn't exist doesn't protect clients; it leaves them exposed to fire sales, rushed decisions, and missed opportunities to preserve security and legacy.

Let's be clear: Funding sources cannot be an afterthought when they dictate the structure of every Long-Term Care plan. Each option carries its own benefits, limitations, tax treatment, and risks. The real challenge is matching the right dollars to the proper structure in a way that aligns with comprehensive financial planning. When consumers — and the advisory community guiding them — proactively evaluate and align funding sources, Long-Term Care planning becomes sustainable, tax-efficient, and capable of delivering multi-generational security.

Every financial planning component is driven by funding, and Long-Term Care is no exception!

20250915