Retirement Income & Healthcare Costs

Your client discussions about retirement or income planning should address Healthcare In Retirement, as it will likely be one of your clients' largest required expenses as they age. Furthermore, most of your clients won't understand how and why healthcare is linked to their retirement income, so let's start here....

According to Bankrate, the average monthly Social Security (SSA) benefit for a retired worker in 2025 is about $1,839.83 per month....or a little more than just $22,000 annually. Far too many Americans (some may even be your clients) don't realize this is a "gross" number, and items like Medicare premiums are usually automatically deducted from their SSA benefits.

In 2025, the basic cost (deduction) of Medicare Part B premiums is $185.00 per month, and Part D coverage for prescription drugs will likely decrease a client's SSA benefits by at least another $30 per month. This means the best-case scenario for a client receiving the average SSA benefit would be $1,492 after paying for Medicare premiums, and any planning predicated on that benefit must be adjusted accordingly.

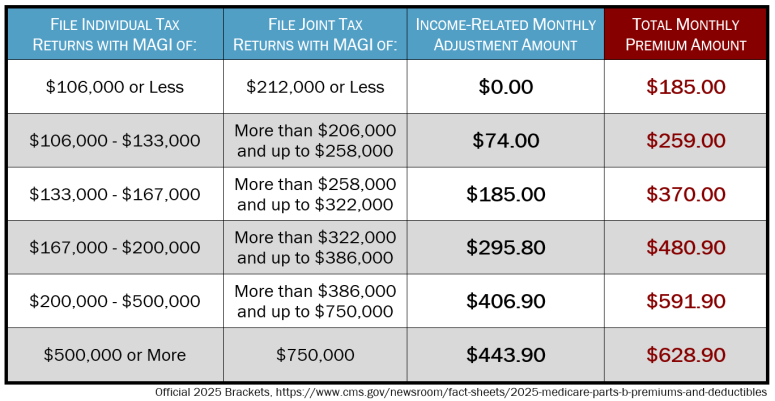

Another reality that cannot be ignored is that the "means testing" of Medicare benefits equates to higher Part B and Part D premiums. This is NOT some bill in Congress under debate - IT'S ALREADY HAPPENING, and most politicians are either uninformed or simply trying to avoid admitting it exists. Please take a moment to click on the graphic to the left to enlarge and review it, so you can see that clients who earn more than $106,000 individually or $212,000 as a couple do, in fact, pay more for Medicare.

Simply put, your higher-income clients' NET SSA benefits reflect the Income Related Monthly Adjustment Amount (IRMAA) "penalty" and their Medicare premium, and you can see how the IRMAA increases as income increases. The chart (viewable directly on the Medicare website) doesn't tell you that the long-term, bi-partisan goal is to shrink the bands and lower the initial income threshold so a larger number of Medicare beneficiaries are subject to increased premiums.

You may also want to help clients understand that as that happens, the historical Cost of Living Adjustment (COLA) for Social Security is approximately 2.1% per year, and the historical increase in Medicare premiums is approximately 7.5%, making basic healthcare costs an ever-increasing percentage of a client's retirement budget. That may hold true in 2024 with an expected 6% SSA COLA and a 9% projected Medicare Part B premium increase.

While we will continue to encourage the advisory community to address Long-Term Care (LTC) Planning for clients, it is critically important to recognize that LTC is excluded by Medicare, Medicare Supplements, and Health Insurance, even though the majority of retirees will require some form of Long-Term Care during retirement. We hope your takeaway from this brief article is that Healthcare In Retirement 101 should be part of your retirement and financial planning discussions with ALL your clients.....

Understanding the cost of Medicare is part of the "Healthcare In Retirement" equation for clients.

20250526