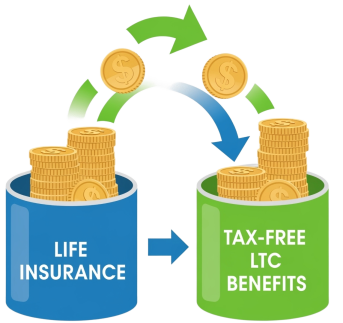

Reposition Life Insurance To Create Tax-Free Living Benefits for Care...

Many Americans have purchased significant amounts of permanent life insurance that, in addition to the death benefits, now include large cash accumulation values. Whether it's to replace income during working years, to provide a more secure retirement for a spouse, or to create a legacy after they are gone, those death benefits are earmarked for beneficiaries. However, as clients age, it's essential to include that life insurance – and its cash values – in their comprehensive financial planning.....Especially if they view those assets as an "emergency fund" to cover catastrophic or chronic illness or Long-Term Care expenses during retirement. If the original goals for their life insurance have changed, consider leveraging the power of The Pension Protection Act (PPA).

Congress enacted the PPA in 2006; however, the provisions for existing life insurance only recently became a vital retirement and tax planning tool. While every situation is unique*, these provisions allow your clients to (1) "upgrade" an existing life insurance policy TAX-FREE to a PPA-Compliant solution, (2) add a spouse/partner that effectively turns a single-life death benefit into a joint-life Long-Term Care Plan, and when needed, (3) take TAX-FREE distributions to cover qualifying Long-Term Care expenses.

Real-World Implications.....

Perhaps the best way to see the power of the PPA is to look at a real-life example. Let's look at Sam Saver, who has a life insurance policy with a $350,000 death benefit initially intended to help replace his income if he passed away before retirement. Over the years, he's paid $100,000 in total premiums into the policy, and the cash value has grown to $200,000. He sees friends and relatives begin to need Long-Term Care and knows that most of those expenses are excluded by Medicare. As such, the goal for the policy has changed, and he now intends to use the cash value in the life insurance to help cover the cost of future expenses for "Healthcare in Retirement." Now, you have an opportunity to help him "upgrade" that plan to mitigate the risk associated with future Long-Term Care needs.

By utilizing the Pension Protection Act and "upgrading" to a PPA-Compliant solution, you can show him how to leverage the $200,000 cash value into $600,000 of Long-Term Care benefits for both him and his wife!! This strategy becomes even more appealing for the tax benefits…..

Turn Taxable Gains Into Tax-Free Benefits!!

Sam's $100,000 (his basis) of premiums in the policy have doubled in value to $200,000, and withdrawals from his life insurance policy could become a tax time bomb if not managed carefully. By "upgrading" to a PPA-compliant solution, the result would be TAX-FREE withdrawals of at least $600,000 of Long-Term Care benefits rather than just the (potentially) taxable withdrawals of the $200,000 of the accumulated cash value in the life insurance.

Perhaps most importantly, by using the tax code to his advantage, it's possible to implement a substantial Long-Term Care plan for the couple with ZERO out-of-pocket cost....

Now is the time to reposition your client's life insurance for proactive Long-Term Care Planning.

* This information is general in nature, and your client should consult a tax advisor or CPA to determine the tax implications of utilizing this type of solution.

20250925