There Are No "Snow Days" for Caregivers

Depending on where you live, today is a ‘Snow Day’, but, unfortunately, for millions of American caregivers, regardless of how deep the snow gets or how bad the roads are, they won't get a "school's closed" robocall giving them a pass for the day. Weather is just one of the factors that make providing care for a family member, friend, or someone who is simply unable to care for themselves a physically demanding and emotionally draining role. This isn’t a new phenomenon, as families have always been providing care for the older generation. However, caregiving is one of the most impactful examples that defines the need for Long-Term Care (LTC) Planning for clients.

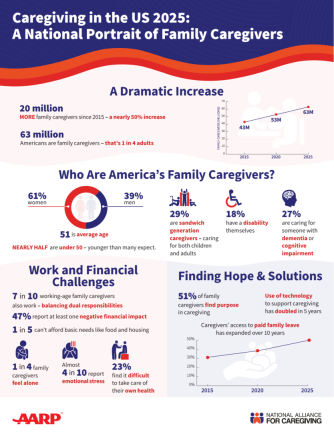

At the very least, proper LTC Planning allows families to provide professional caregivers to do the things their spouses or loved ones can no longer do for themselves. According to the National Alliance for Caregiving, family caregivers now form the invisible backbone of American communities, with more than 63 million adults — nearly one-quarter of the U.S. adult population — providing ongoing care to a family member with a medical condition or disability. This represents a 45% increase since 2015, underscoring the scale and acceleration of a growing national problem. Without proper planning, your clients’ experiences will look more like this: Caregiving: The Second Career Hiding in Your Financial Planning.

If it’s bad now, things are only going to get worse…..

The Care Economics for The Silver Tsunami

On January 1, 2026, the first Baby Boomer turned 80, and in 2029, the last Boomer will turn 65, and at that point, 75 million Americans will be nearing or in retirement – All one day closer to a loss of independence and the need for care, much of it provided by family caregivers. Recent national data from the Caregiver Action Network shows that family caregiving is associated with significant financial strain and income suppression across the United States. More than 70% of family caregivers report financial hardship, with many living paycheck to paycheck and spending a meaningful share of household income on care-related expenses. The economic impact is particularly severe for women, who are far more likely than non-caregivers to experience long-term financial instability as a result of caregiving responsibilities.

The financial toll on family caregivers is severe, and the situation will only get worse as those 75 million boomers get older. According to the National Alliance for Caregiving, one in five caregivers has been forced to move in with the person they are caring for simply to manage expenses. Even then, cost-cutting often isn’t enough. Nearly half of working caregivers report that ongoing care-related expenses have exhausted their savings, directly undermining their own financial security and retirement plans. On average, family caregivers supporting someone over age 50 spend more than $5,500 per year out of pocket on costs not covered by insurance or Medicare — an amount that exceeds 10% of the average caregiver’s income, according to AARP.

With clients stuck at home on a cold, snowy winter day like today, this is your opportunity to engage some of them about Long-Term Care Planning with a simple message: You need a plan that ensures there’s a caregiver on a day like this!

Long-Term Care will impact most of your clients and their families, and proactive planning today will avoid reactive chaos and crisis when care is needed.

20250126