There Are No Off Days for Caregivers

There is an undeniable truth that as your clients age, even simple chores can become difficult or even impossible to complete...That's when some form of Long-Term Care or Caregiving becomes necessary. From mundane tasks like doing laundry to more complicated ones like electrical work or remodeling, unfortunately, “Honey-Do List” items don't take care of themselves and can't be put on pause for any holiday or celebration.

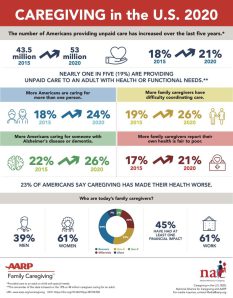

This isn’t a new phenomenon, as families have always been providing care for the older generation; however, according to the National Alliance for Caregiving, the trend in the United States paints an alarming picture of a growing problem:

- As of 2020, there were more than 10 million American adults providing unpaid care to an adult with health or functional needs.

- Most Caregivers are female (67%), averaging 50 years of age.

- More than half (61%) are providing care and still working.

- Most of the care is being provided because it stems from chronic or age-related conditions or limited Activities of Daily Living, and those expenses are excluded by Medicare.

Quite simply, Long-Term Care Planning better positions your clients and their families to hire professional caregivers to do the things their spouse or loved ones can no longer do for themselves....

The Economics of Providing Care.....

According to AARP, for the most recent stats from 2021, "the estimated economic value of family caregivers’ unpaid contributions was approximately $600 billion.....This conservative estimate does not consider the financial cost of care (out-of-pocket and lost wages) or account for the complexity of care provided." That estimate also represents a significant increase "from $470 billion in 2017 and continues a 25-year trend of increasing economic value."

The pandemic and continued difficult economic environment have only served to amplify the financial impact of the problem. In fact, 20% of caregivers had to move in with those they cared for to reduce expenses, as the National Alliance for Caregiving reported. And, despite efforts to reduce expenses, 47% of working caregivers report continuing increased expenses caused them to use all or most of their savings, which has a direct impact on the financial security and retirement plans for caregivers. For the average family caregiver, caring for someone over the age of 50, the caregiver is, on average, spending $5,531 per year out of pocket just for expenses not covered by insurance or Medicare. According to AARP, this is more than 10 percent of the average income for caregivers.

Regardless of your advisory role, ask yourself a simple question about every client: Without proper planning, what does providing care, arranging for care, or finding informal homemaker services look like for a healthy spouse/partner or loved ones?

So, the next time a client mentions their "honey-do list” on a holiday, has a Monday off, there's blizzard condition winter day, or there's a hurricane headed your way, maybe that’s another chance for you to engage a client on the benefits of Long-Term Care Planning.

The need for providing care will affect the entire family, and clients are waiting for you to begin implementing proper planning to ensure multi-generational security.

2300829