Healthcare In Retirement: An Economic Reality Check for An Aging America

We are now at the crest of the Silver Tsunami — the unprecedented wave of Baby Boomers turning 65 — a phenomenon that began years ago and will continue until 2030, when every member of that generation will be at least age 65. For the next five years, 10,000 Americans will reach retirement age every single day in what is arguably the most concentrated aging event in U.S. history. The impact will ripple through healthcare, long-term care, and retirement planning until the wave fully breaks. As Boomers age, government estimates indicate that most Americans will experience the need for Long-Term Care (LTC); the only questions are the degree and duration. Combine that reality with the sheer size of this generation, and the effect on LTC service delivery and the broader economics of the healthcare system will be profound.

Healthcare and An Aging America…..

According to Ken Dychtwald, president and CEO of the consulting firm AgeWave, "anyone who thinks the boomers will turn 65 and be the same as the generation before are missing out on the last 60 years of sociology. The boomers change every stage of life through which they migrate. We weren't prepared for the boomers. There weren’t enough hospitals or pediatricians. There weren’t enough bedrooms in our homes. There weren't enough schoolteachers or textbooks or playgrounds. The huge size of this generation has strained institutions every step of the way."

It's clear Boomers will reshape the healthcare system yet again — particularly in how and where care is delivered. While it's difficult to simplify this complex topic, let's begin by looking at three aspects of the healthcare system: Physicians, Home Health Care, and Facility-Based Care.

Doctors Understand Economics 101.....

Demand for healthcare — and Long-Term Care — will soon outstrip available supply. No amount of government tinkering can change the laws of supply and demand. If reimbursement rates don’t make economic sense, doctors and facilities can, and will, opt out of Medicare and Medicaid.

It’s already happening.

In the coming years, the aging of the Baby Boomer generation will only accelerate this imbalance. Even if politicians make changes, they cannot legislate away basic economics. When the cost of delivering care exceeds what government programs are willing to pay, the logical business decision for many providers is to reduce or withdraw participation. That means fewer options, longer wait times, and increased competition for care — particularly for services that Medicare and Medicaid already reimburse at lower rates.

As more providers step back, access will depend less on what care you need and more on how you can pay for it — and whether you’ve planned ahead.

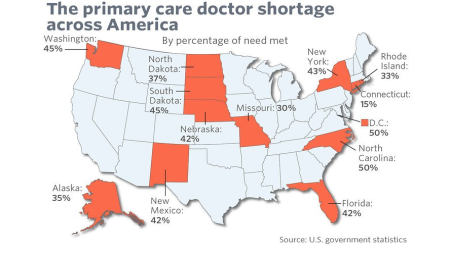

The Physician Shortage Is Already Here

According to the American Medical Association and Janis M. Orlowski, MD of the Association of American Medical Colleges (AAMC), “We talk about a worsening physician shortage, but I want to make sure

that people understand that there's a physician shortage today,” she said, adding that, according to data from the U.S. Health Resources and Services Administration (HRSA) confirms, “There is a

shortage right now.”

Furthermore, an AAMC study projects a shortfall of 37,800 to 124,000 physicians by 2034, including 17,800 to 48,000 primary care physicians and 21,000 to 77,100 specialists. And those projections were made before COVID-19 further stressed the system. As AAMC President and CEO David J. Skorton, MD, notes, the pandemic only intensified the pressures.

The supply side is already under strain. Based on these realities, Americans will likely need to adjust expectations for how — and where — healthcare is delivered. If access to primary care contracts further, it will create ripple effects throughout the entire healthcare system, directly impacting the delivery and availability of Long-Term Care services.

Home Healthcare: Maintaining Independence & Choice...

Americans love having choices — where we travel, what we eat, how we entertain ourselves. The same applies to healthcare. Even if we set aside concerns about physician shortages or the rise of a two-tiered healthcare system, one fact remains: most people want to age gracefully, independently, and in the comfort of familiar surroundings.

That preference drives a growing shift toward home-based and community-based care. Demand for these services is expected to surge, creating intense pressure on companies that provide them. And, as with every other part of the healthcare system, rising demand will inevitably influence cost and availability. According to Kaiser Health News, “acute shortages of home health aides and nursing assistants are cropping up across the country, threatening care for people with serious disabilities and vulnerable older adults.” This isn’t a distant worry — it’s a present reality that will only intensify as the Silver Tsunami advances.

In a more direct way, Shawn Rimerman, Owner of ComForcare Senior Services in St. Louis, Missouri, illustrates the problem we face. According to Shawn, “we go to great lengths to screen our caregivers and find the right people to work for us, who 1) can care for our clients in the way we expect; and 2) who will do so under today’s economic model is a huge challenge. The demand and the marketplace dictate what we can charge for those services, and simply put, our highest cost is paying our caregivers a fair hourly rate. As the aging of our population continues, the onus will fall on individuals and families to meet their needs for Long-Term Care services. Realistically, the financial burden of doing so without having to deplete one's life savings cannot be met through any current or potential government program.”

Facility-Based Care: The Good, The Bad & The Ugly...

Most people needing medical attention or Long-Term Care (LTC) try to avoid facility-based care. Unfortunately, Medicare and Medicaid reimbursement rules leave little flexibility, often making facility care the default — even when it’s not what the patient wants and even when it’s more expensive for the system. For example, I met with an advisor and his client who described her husband’s recovery from surgery. Complications led to infections, requiring 30 days of IV drug therapy. The only service provided at the LTC facility was a daily nurse visit to replace the IV solution. Had Medicare allowed this care to be delivered at home by a private-duty nurse, the program could have saved more than $6,000 — and the patient could have recovered in familiar surroundings.

Outdated restrictions on where certain care can be provided are inflating costs nationwide. With another 10,000 Boomers turning 65 every day, the financial and logistical strain on facility-based care — and on the government programs funding it — will only intensify.

The Kaiser Foundation, a non-profit foundation focusing on the significant healthcare issues facing the U.S., compiles an enormous amount of statistics annually. Analyzing the following statistics highlights a somewhat scary scenario:

- There are about 15,000 Certified Nursing Facilities in the U.S.

- The total number of beds in those facilities is approximately 1,678,357.

- The occupancy rate for those facilities is currently about 80%.

- The primary payer for 63% of the residents is currently Medicaid.

- 70% of all of these facilities are operated on a "for-profit" basis.

- Based on current occupancy, there are roughly 336,000 available 336,000 beds.

Taken at face value, these statistics paint a grim picture — but it gets worse. Combine them with U.S. Census estimates that the population over age 65 will increase from 47 million (2015) to nearly 87 million by 2050. When demand exceeds supply, it won’t matter what government programs promise. Seventy percent of “for-profit” facilities can simply choose not to participate.....That's the Economic Reality of Long Term Care.

The takeaway? A pragmatic view of the future delivery of Healthcare In Retirement and Long-Term Care is essential. Planning isn’t just about protecting assets — the right plan may be your clients’ best negotiating chip to access quality care when they need it. The fundamental law of supply and demand will likely shape the cost, choice, and availability of care far more than most people realize today.

Now is the time to make Healthcare In Retirement and Long-Term Care Planning a priority for clients who have not addressed it.....If you have questions, we’re just a phone call or click away!!

20250815