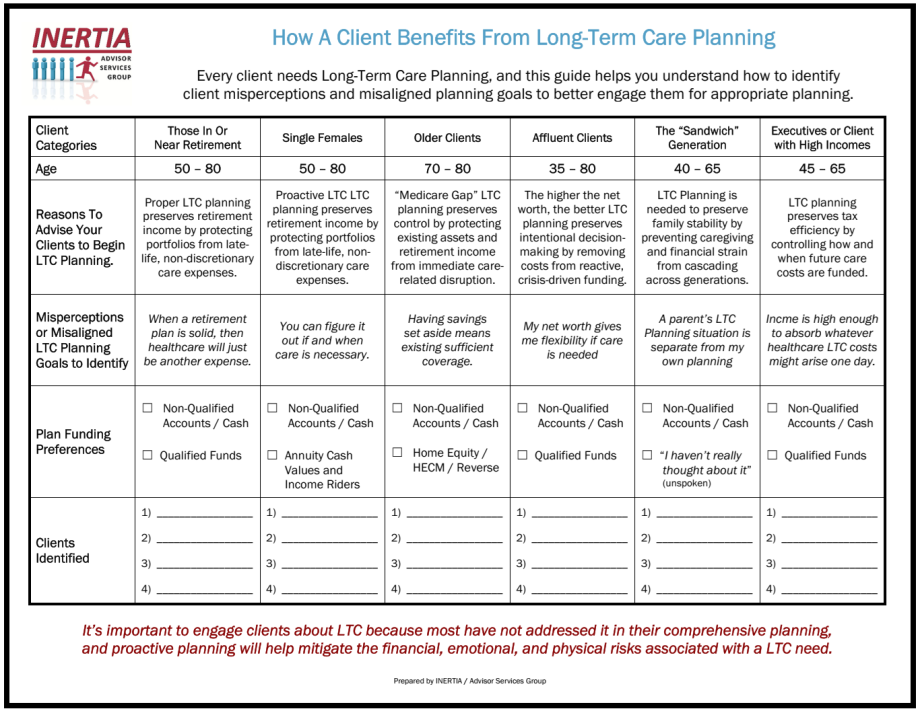

How Clients Will Benefit from Long-Term Care Planning

Long-Term Care risk is not limited to certain types of clients—it exists across every household, balance sheet, and stage of life. What differs is how the risk shows up, how it is funded, and whether it has been addressed intentionally or left to chance.

This tool is designed to help you assess how your clients experience LTC risk, identify common misperceptions or misaligned goals, and understand the planning and funding preferences that already exist—often implicitly—within their financial lives.

Effective Long-Term Care Planning is not a standalone discussion. It is a necessary extension of financial, retirement, estate, and tax planning, addressing critical questions such as:

-

Who will make decisions if care is needed?

-

Where will care be delivered?

-

How care will be funded—by design rather than liquidation?

Review the framework below to evaluate how each client’s situation aligns with these planning realities, then use the insights to prioritize next steps. Once you’ve completed your review, contact us to discuss observations, gaps, and proven strategies for integrating Long-Term Care Planning into your existing client process.

Download a copy or review the graphic below, and after identifying your "target" clients, please contact us

to schedule time to discuss the results and successful strategies to approach those on your list.

Adobe Acrobat document [107.6 KB]

20250105