Gaping Holes in “The Safety Net”

Just in case you're living in a bubble, there's an ongoing debate about the viability and future of America's "Safety Net" programs, and it's easy to see why these programs are the elephant in the room. When you consider the ongoing and future costs and a federal debt that recently passed $34 trillion, it's safe to say - one way or another - it's a question of WHEN and not IF changes are on the way......

Regardless of your political leanings, it’s difficult to believe our country can maintain the spending trajectory for Medicare, Medicaid, and Social Security in their current form. Without arguing the merits of these programs, neither party has really presented any solutions to actually make them viable in the future. Making matters worse, with respect to your clients' future Long-Term Care expenses, there are already gaping holes in the American safety net, and the majority of your clients don't want to be dependent on ANY government program.

One day soon, we'll get past the current crisis, and healthcare will still be on everyone's mind, so perhaps you should be prepared to help your clients better understand The Safety Net with respect to Healthcare in Retirement and Long-Term Care needs, which will likely be required in the future.

A Look At Medicare.....

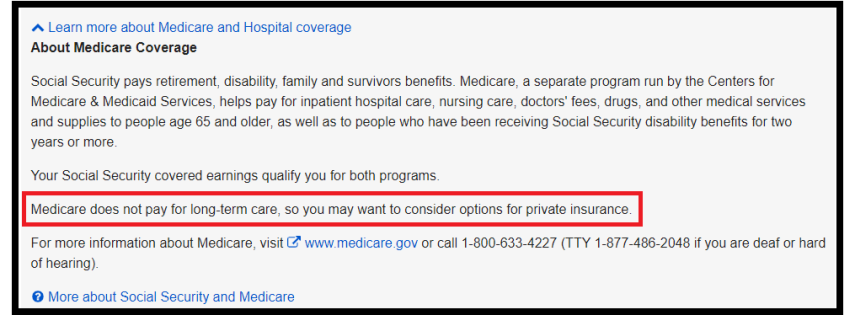

It’s important to recognize that Medicare offers limited benefits to cover Long-Term Care expenses. Relying on Medicare for chronic or age-related care really isn’t a good "solution" because a quick visit to the Medicare website can verify that fact. If you need another reference point, consider the Social Security statement you used to receive each year.

The government stopped sending those statements simply because of the high cost, so encourage clients to click on this link to set up an online account with the Social Security Administration to view their current benefit projection. Once your client registers, they can their statement and and scroll down to the page to see this:

Regardless of whether the government makes changes to the current programs, both Medicare and the Social Security Administration appear to be giving a strong indication that your client's financial planning should include a Long-Term Care component!!

And then there's Medicaid.....

OK, so if Medicare isn’t going to help you, then what about Medicaid??

First, your clients should know that Medicaid is essentially a "welfare" program, and it's important to research and learn about what Medicaid is and who it covers. The Medicaid program today will cover Long-Term Care needs, but only after you’ve exhausted nearly all of your assets. Recognize that the key part of the last sentence was the word “TODAY”. More to the point, planning on Medicaid to cover your Long-Term Care needs in the future may be only a slightly better plan for those needs than buying a Lottery ticket.

Ignoring the fact that Medicaid is welfare, it may be fiction or a cruel pipe dream; just consider the economic reality of senior care for a moment and the availability of a “Medicaid bed”. However, if your clients feel that Medicaid could be part of their future, three realities should be realized – (1) They're going to give up much of the control of their care, (2) where they receive that care, and (3) nearly guarantee a path to becoming destitute.

Do the research, become educated on the topic and you will quickly see the importance of Long-Term Care planning as part of a comprehensive financial plan.

Please contact us to begin discussing Long-Term Care planning for your clients!!

2100701