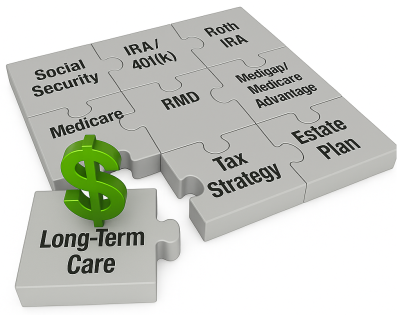

Every Retirement Plan Is Incomplete Until It Addresses Long-Term Care

One of the primary goals of American consumers is to position themselves for a secure and comfortable retirement. Throughout their working years, this may include (1) paying into Social Security, (2) contributing to an IRA, 401(k), or other qualified retirement plans, or (3) using after-tax dollars to build supplemental retirement savings.

According to The Investment Company Institute, total U.S. retirement assets now exceed $44 TRILLION as of December 31st, 2024, and retirement savings accounted for a significant portion of total U.S. household assets. Given this, protecting these assets, when possible, is key to a successful retirement. Unfortunately, few things threaten an American's retirement years more than unexpected healthcare costs or the need for Long-Term Care (LTC).

Fidelity Investments estimates that a 65-year-old couple retiring today will need an estimated $330,000 to cover health care costs in retirement, according to Fidelity's Retiree Health Care Cost Estimate. To make matters worse, this estimate does not include the potential cost of future LTC expenses. This creates a serious planning gap, especially since most Americans fail to incorporate Healthcare in Retirement or LTC into their retirement strategy.

Where to start.....

The first step is understanding how healthcare costs, particularly those tied to Medicare and Long-Term Care needs, intersect with retirement income planning. Unfortunately, many clients still believe that Medicare covers all their healthcare expenses in retirement—and worse, that it’s free or automatically included with Social Security.

Advisors must correct these misconceptions. Medicare is neither free nor comprehensive, and its premiums are now means-tested, based on a client’s Modified Adjusted Gross Income (MAGI), which includes taxable income and tax-exempt interest. As income rises, so do premiums.

Worse yet, most proposals aimed at “preserving” Medicare involve lowering the income thresholds for means testing—effectively penalizing clients who’ve saved diligently. That creates a dangerous catch-22: the more successful the retirement strategy, the more expensive healthcare becomes.

IRA's & 401(k) Dollars To The Rescue....

As discussed earlier, most Americans will rely on three core sources of retirement income: Social Security, tax-deferred retirement accounts, and after-tax savings. What many advisors overlook is how effective retirement accounts can be in funding Long-Term Care (LTC) strategies, especially after age 59½, when clients can begin accessing these dollars without penalty.

Modern LTC solutions allow for systematic and tax-efficient repositioning of qualified assets, using scheduled taxable distributions to fund a plan that provides tax-free LTC benefits when needed. If care is never required, most solutions return value to the estate through a tax-free life insurance death benefit, adding estate planning value to a retirement income decision.

This approach also aligns with broader income and tax planning strategies, particularly when helping clients decide when to start Social Security benefits. Many still default to early claiming without understanding the long-term tradeoffs. For clients who can delay Social Security, using qualified assets for LTC planning can help bridge the income gap while also reducing future Required Minimum Distributions (RMDs), now beginning at age 73.

Understanding the relationship between Social Security, Medicare, and retirement income is essential. For many clients, strategically utilizing retirement accounts — even before RMDs kick in — can be a powerful way to implement LTC planning and mitigate both healthcare costs and tax exposure in retirement.

Making After-Tax Dollars Work Harder....

Another effective way to implement Long-Term Care (LTC) Planning is by leveraging after-tax retirement savings—funds typically held in checking accounts, money market accounts, CDs, or non-qualified annuities. Especially in a still-volatile rate environment, it’s critical to ensure these assets are working as hard as possible to protect clients' long-term security.

What many advisors and consumers don’t realize is that The Pension Protection Act (PPA) of 2006, with key provisions becoming active in 2010, created a powerful tax advantage for LTC Planning. Specifically, cash value withdrawals from certain annuities can now be used to pay qualified LTC expenses or premiums, without triggering a taxable event, if the annuity meets PPA-compliant requirements.

This strategy allows clients to reposition idle or underperforming after-tax dollars into solutions that continue to grow tax-deferred, while providing income tax-free benefits if care is needed. And if care is never needed, the remaining value still passes to beneficiaries, often with enhanced death benefit features.

These are just some ways retirement assets — qualified or non-qualified — can be an effective use of retirement savings for meaningful LTC Planning. Depending on the individual’s situation, there are numerous ways to build a tailored strategy that provides protection and flexibility. In 2025, as fiduciary and compliance standards evolve, financial professionals face increasing scrutiny over addressing healthcare and long-term care risks within retirement planning frameworks.

Proactively integrating the Long-Term Care Planning discussion is no longer just best practice; it is a professional and compliance imperative to meet client needs and uphold planning standards.

20250526