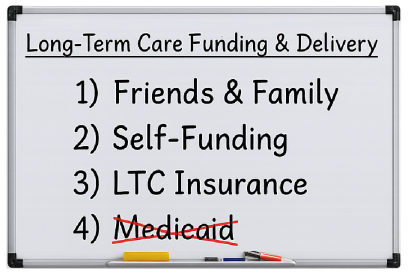

Eliminate Medicaid As A "Planning" Option

During your clients' working years, meeting financial obligations can be a challenge, but it's a different story altogether when it comes to those obligations in retirement. Most Americans plan to cover retirement expenses using a combination of Social Security, pensions, and retirement plan distributions. Depending on health and actual retirement age, those sources may need to last 30 years or more. Unfortunately, many Americans fail to anticipate one of the most expensive—and often underplanned—financial obligations in retirement: Healthcare Costs.

The Reality of Healthcare In Retirement

One tricky part of the healthcare discussion is Medicare, because too many people confuse Medicare with Medicaid. While both are government-run programs, they are operated and funded by different parts of the government and primarily serve different groups. Medicare is a federal program that provides health coverage if you are 65+ or under 65 and have a disability, no matter your income. Medicaid is a state and federal program that provides health coverage if you have limited assets and a very low income. Perhaps more worrisome is that there's no guarantee either that it can maintain its current benefits, for how long, or how the government might change what or how much it covers.

Another consideration is that, according to Fidelity Investments, the average American couple will spend approximately $330,000 during retirement on out-of-pocket Medicare premiums and healthcare costs excluded by Medicare – It’s a big list, and right at the top is Long-Term Care, which is also not included in the Fidelity estimate. Too often, when advisors discuss future healthcare and Long-Term Care needs, the conversation drifts to Medicaid as a fallback. It's time to stop allowing Medicaid to masquerade as a "planning" strategy—and eliminate it as a serious option for most clients.

Medicaid Qualification Is No Easy Escape

Medicaid is essentially a welfare program funded by both state and federal governments to provide healthcare for the indigent. Becoming "eligible" for Medicaid isn’t just difficult—it comes with consequences and tradeoffs that directly contradict what most clients want in later life. Asset ceilings are incredibly low. A non-institutionalized spouse can keep only half the couple’s assets—roughly $22,000 to $110,000 in most states (home and a few personal items excluded). Shifting money around rarely helps. The Medicaid “look-back” period penalizes transfers it deems sheltering. Even irrevocable trusts are scrutinized—funding one still counts during that 5-year window. Each disallowed transfer creates a penalty period during which Medicaid won’t pay, sometimes lasting months or even years.

And even if clients manage to qualify, estate-recovery rules can claw back “protected” assets after death.

Bottom line: Medicaid is a last-resort safety net for the truly impoverished, not a viable Long-Term Care strategy for anyone hoping to retain control or dignity.

The Harsh Realities of Medicaid-Funded Care

Even if eligibility is achieved, the experience often doesn’t match expectations:

- While most people prefer home-based care, Medicaid often only covers nursing home care.

- Medicaid may pay for a facility, but clients have little or no choice in where that care is delivered.

- Nursing homes are not required to accept Medicaid patients. An open bed across town—or across the state—might be the only option.

- Clients on Medicaid rarely have access to private rooms and are forced to accept what’s available.

- Medicaid Home Health Care is a pipedream for most families. While technically available in many states, it is often severely limited in hours, scope, and provider availability. Reimbursement rates are so low that many agencies won’t accept Medicaid, and those that do frequently face staffing shortages, long waitlists, and care caps. The end result? Families are left with inconsistent, insufficient care, or no care at all.

Medicaid Access Is Shrinking

Given the current upheaval surrounding Medicaid eligibility redeterminations and payment delays, it's no longer reasonable to view the program as reliable. Headlines nationwide paint the same picture: access is shrinking, providers are frustrated, and the system is buckling under pressure. A recent McKnight’s article bluntly described a “new economic reality” where facilities are overhauling their Medicaid strategies due to chronic reimbursement delays, staffing pressures, and regulatory burdens. The Office of Budget and Benefit Balancing (OBBBA) is aggressively pushing cost containment and payment realignment, creating a cascade of issues:

- Payment lags are now stretching 60–90 days or more.

- Many facilities are limiting or rejecting Medicaid admissions altogether.

These aren't theoretical problems. They're happening right now—and they completely undermine the idea of Medicaid as a dependable fallback in any serious long-term care plan.

2028 Home Equity Cap Will Disqualify Even More

And just when you thought Medicaid couldn’t get more restrictive, there’s more.

Starting January 1, 2028, the OBBBA will impose a $1 million hard cap on home equity for Medicaid Long-Term Care eligibility. There is no inflation adjustment to this limit.

That means: A home valued over $1 million—regardless of mortgage or income status—will disqualify someone from receiving Medicaid LTC benefits, so families in moderate-to-high cost housing markets (e.g., Florida, California, Colorado, Arizona) could easily hit this cap, even with a modest home. Homes worth $800K today could exceed the threshold through normal appreciation in just a few years. Clients who previously assumed their home was a protected asset may now find that their very home becomes a barrier to care access. This isn’t just policy—it’s a warning shot.

Yet another reason Medicaid should never be considered a default planning solution.

Why We’re Moving Away from Partnership Plans

This is also why we’ve grown cautious in promoting Partnership plans, which were designed to make LTC insurance more appealing by allowing clients to preserve some assets if they transition to Medicaid. But here’s the catch: State participation in Partnership programs is optional, and the federal government never mandated a consistent national framework. What if Medicaid does not exist in the same form (or at all) when today’s 60-year-olds are in their 80s? Wouldn’t that make encouraging clients even to consider spending down assets or structure plans around uncertain future Medicaid benefits be irresponsible and possibly reckless?

Fiduciary Duty Demands Better

Any advisor working under a fiduciary standard cannot afford to ignore the realities of Long-Term Care. Recommending—or silently allowing—clients to impoverish themselves to pursue hypothetical government benefits is a breach of duty. Worse still is avoiding the conversation altogether. A true fiduciary must: Raise the issue proactively, explain realistic funding options, and help clients build a plan that protects assets, autonomy, and dignity

The Takeaway: Medicaid Is Not A Plan

There is no realistic world in which Medicaid can or should be the core strategy for your clients' Long-Term Care planning. It's increasingly unpredictable, underfunded, and unavailable when and where your clients will need it most. Start the conversation now—while they still have choices. Regardless of your advisory role, it’s time to address this topic as part of your clients’ comprehensive financial planning and eliminate Medicaid as a viable alternative.

At the end of the day, consider addressing this topic as part of your clients' comprehensive financial planning and eliminate Medicaid as a viable alternative....

20250714