Chaos & Crisis: The Advisory Cost of Failing To Plan for Long-Term Care

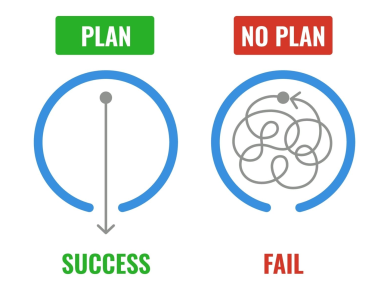

Planning for Long-Term Care (LTC) can be challenging, and it's a conversation far too many in the advisory community allow to be put off. Perhaps because it involves contemplating scenarios that aren't pleasant for clients or the engagement is perceived as a head-on discussion about aging, sickness, and death. Nonetheless, as uncomfortable as it might be, almost every advisor-led plan must have an ending – known or unknown – and failing to discuss and plan for LTC will only lead to chaos and crisis when care is needed.

Imagine the all too common scenario where a client has no LTC planning, and their declining health makes completing many Activities of Daily Living impossible, requiring extensive and costly care excluded by Medicare. The client's family experiences turmoil negotiating caregiving roles, navigating the complexities of arranging appropriate care, and grappling with legal and financial burdens associated with the lack of proper planning. Sadly, this is a reality for countless families whose advisors fail to broach the subject and encourage LTC Planning. The truth is, the only thing worse than discussing LTC with clients is their need for it without any preparation.

Here's why initiating these planning conversations should be a priority…..

Financial Implications: Direct and indirect financial costs must be a consideration when encouraging LTC Planning. From the basics of adult daycare to expansive memory care, expenses for LTC can be staggering. As the bills accumulate, there is a potential to drain savings and retirement funds quickly. Without proper planning, your clients and their families may experience a financial crisis, scrambling to cover the expenses. However, beyond the core financial cost of care, the interrupted lives, careers, and relationships of those in a client's orbit carry a difficult, if not impossible, cost to calculate.

Physical and Emotional Toll: The emotional toll of not having a plan for LTC can be overwhelming, and it's not just about the person needing care; LTC affects the entire family. The stress, uncertainty, and guilt of making quick or split decisions in a crisis can take a severe toll on everyone involved. For many, the emotional toll often manifests itself physically on a spouse or family caregiver……Another cost that cannot be calculated or covered.

Limited Options: A lack of planning restricts the choices available for care, and your clients may end up in facilities or situations they wouldn't choose or don't align with their preferences. A well-thought-out LTC plan allows more control over the type and quality of care received.

Strained Familial Relationships: When the responsibility of caregiving or securing alternatives for care falls on family members, it can become overwhelming and lead to tension or resentment among family members. The situation is exacerbated without planning.

The advisory community should recognize that initiating discussions for LTC Planning is more than just dollars and cents; it's about preserving dignity, maintaining autonomy, and easing the burden on loved ones during the most challenging times in life. Starting conversations is ultimately an act of compassion towards clients and their families, allowing the advisor to provide guidance and tailor solutions to fit individual needs.

The discomfort of LTC shouldn't be the discussion.....But it will undoubtedly be part of the crisis and chaos of needing care and not being prepared. So, as 2024 begins and less than 20% of Americans have a plan for LTC1, it's time to break the silence and pave the way for a more secure and dignified future for your clients and their loved ones.

1 What isn't covered by Part A & Part B?, https://www.medicare.gov/what-medicare-covers/what-isnt-covered-by-part-a-part-b

2 The OneAmerica LTC Consumer Planning Study, administered by Hanover Research, March 2022, https://www.oneamerica.com/campaigns/survey/ltcsurvey