Clients Are Concerned About Healthcare Security.....Are You Listening?

As the wave of Baby Boomers continues heading towards or into retirement, it's surprising to hear that many in the advisory community may be ignoring their clients. Unfortunately, it seems that year after year, study after study - like this 2023 survey by The Nationwide Retirement Institute - tells us how 66% of Boomers may be "terrified of what health care costs may do to my retirement plans." That's up from 56% in 2014, just ten years ago.....Yet, that same survey indicates only 20% of those Boomers have discussed these concerns with an advisor.

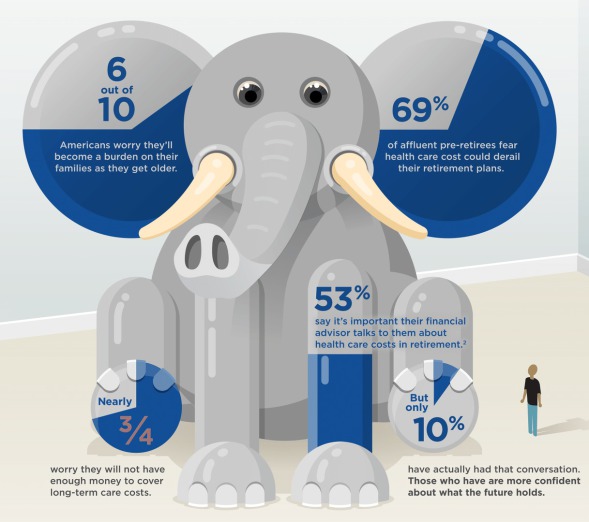

When most surveyed "aren't sure or can’t estimate annual healthcare costs (expected) in retirement," and you see the statistics in the Nationwide graphic below, then clearly, there's a significant communication gap between the advisory community and their clients - across the financial services spectrum!

Unfortunately, the Nationwide survey, and many like it, consistently show how consumers want and need advisors to address Healthcare In Retirement and Long-Term Care Planning, yet far too many advisors continue to adequately address their retirement concerns.

Perhaps, in a "Post-COVID" environment, with heightened "fiduciary" standards, more emphasis will be placed on these topics in a client's risk management, retirement, or financial planning.

Are you ready to focus on Healthcare In Retirement & Long-Term Care Planning for your clients?

230919