A Closer Look At Insurance-Based Long-Term Care Planning Solutions

Are you familiar with the innovation insurance carriers bring to Long-Term Care (LTC) planning solutions? If not, it may be time to expand your horizons to see the evolution of the marketplace. Contrary to what you might read or hear, today's market reflects an expanding and diverse group of high-quality solution providers—each responding to the unique needs of consumers and the advisors who guide them.

The Changing Landscape of Today's Solution Providers

It's important to understand the impact of a low-interest-rate environment, now in its second decade after the financial turmoil began in the summer of 2008. These low interest rates have been a primary reason for premium increases on existing LTC insurance solutions. As a result, many solution providers have had to re-evaluate their presence in the market despite demographic trends that make LTC planning more relevant than ever for your clients.

Additionally, the advisory community has evolved — or at least it should have – to recognize that comprehensive planning is incomplete without proactively addressing LTC risks for clients. With millions of boomers in or near retirement, LTC isn't a niche concern; it's a core risk every client faces, and ignoring it undermines the credibility of any long-term strategy. Many of today's innovative solutions allow the advisor to help clients position LTC as an asset on their balance sheet rather than just another expense on their income statement.

A younger planning audience also drives this shift! Gen X and Millennials see family members needing care, so they understand LTC Planning should be part of their broader long-term financial well-being, or must be aligned with other financial planning goals. And because most clients can't fund every financial priority at once, many solution providers now offer linked-benefit plans that combine life insurance or annuities with LTC features, maximizing flexibility without requiring new dollars.

The Silver Tsunami and Market Momentum

The convergence of aging demographics—the so-called Silver Tsunami—and rising care costs has created a national inflection point. With 10,000 Americans turning 65 each day, the LTC planning conversation is no longer optional for you or your clients. It's imperative. As more families experience caregiving firsthand, demand for practical, insurance-based LTC Planning solutions continues to grow, but probably not how most think - Traditional stand-alone LTC insurance that once dominated the market has lost it's appeal.

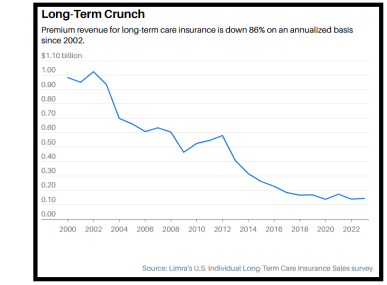

Barron's explains that's no longer true, as "in 2023, insurers issued only 35,000 stand-alone LTC policies, a significant drop from over 585,000 in 2000. Premium revenue also decreased from $1 billion in 2002 to $143 million in 2023."

Based on LIMRA data, most consumers prefer options that offer (1) guaranteed premiums and (2) residual value or death benefits if care is never required. The continued growth of these products underscores a clear shift in demand toward solutions that integrate protection and care planning within a single structure. Advisors are seeing rising interest because these policies deliver flexibility, value, and peace of mind for clients who don't want a "use it or lose it" scenario. As new sales of traditional LTC insurance continue to decline, consumers are gravitating toward hybrid solutions that offer more transparency and perceived value.

Utilizing Alternative Funding Options for LTC Planning

Plan funding remains a key driver of LTC engagement, as the advisory community can now access solutions that let clients repurpose existing life insurance, annuities, or even qualified retirement dollars to create a care plan—often with minimal or no new out-of-pocket expense. Carriers continue to innovate to take advantage of the tax code and structure plans that transform taxable gains into tax-free LTC benefits1.

Flexible LTC Planning Options

Today's solution providers offer more flexibility than ever. You can build plans that cover 100% of anticipated care costs or target a defined benefit amount or time horizon. Many advisors are layering solutions across a client's portfolio to meet goals from multiple angles. Additional customizations, like inflation protection, elimination period options, and varying benefit structures, allow customization that aligns with each client's needs, risk tolerance, and preferences.

Due to the popularity, more joint-life LTC plans are in the market (or proposed) than ever, as these plans allow couples to share benefits, streamline underwriting, and reduce overall costs compared to two individual policies. For married clients, joint-life options can efficiently address care planning together, especially when budgets or health considerations differ.

For younger clients, there is a solution that puts a pure Hybrid Life/LTC on a guaranteed Index Universal Life (GIUL) chassis. This option is designed to fit seamlessly into early-stage financial offering LTC Planning with (1) guaranteed premiums and (2) locking in year-to-year market gains to increase LTC benefits rather than costly inflation protection riders. This structure will appeal to Gen X and elder Millennials who want LTC coverage without sacrificing other planning goals or market participation.

The Role of Tools Like HALO™

Tools like the HALO™ (Health Analysis and Longevity Optimizer) Care Planning Assessment are helping advisors like you turn client conversations into actionable planning. HALO™ equips you to walk clients through the projected scope, cost, and duration of future care while capturing their preferences and potential funding gaps. It brings structure and objectivity to a complex and emotional conversation so plan designs can be confidently tailored to a client-specific LTC strategy.

As the LTC Planning space evolves, solution providers are meeting the moment—offering greater innovation, more flexible designs, and funding strategies aligned with today's planning realities. Advisors who embrace this evolution, use tools like HALO™, and proactively lead the LTC conversation will stand apart.

The Silver Tsunami isn't coming—it's already here, and your clients need a guide who's ready.

1 As always, collaborate with a tax advisor to determine what works best for each client.

20250503