The Medicare Professional - Elevate & Expand The Conversation

As a Medicare professional, you understand how the age 65 transition is a major milestone for Americans. However, even with successful consumer engagement, your clients still face a significant gap since Long-Term Care (LTC) is excluded by Medicare, a Supplement, or Medicare Advantage plans. This scenario is precisely why you should consider collaboration to bridge the coverage gap with Long-Term Care Planning.

You Already Know the Problem:

- Medicare only covers short-term, skilled rehab under specific conditions.

- Clients assume they’re covered—until they’re not.

- The Silver Tsunami is here, and millions have not planned for it.

- Your clients have advisors, tax professionals, attorneys, etc., who avoid the topic.

- Self-funding isn’t a plan; it’s the default position of a planning void.

Surveys indicate more than 80% of Americans1 have failed to plan accordingly and remain in the default position of “self-funding” future care. However, by extending the Medicare discussion and using your expertise, you can explain how the real cost is far more than financial, and how it becomes a physical and emotional burden paid by spouses, adult children, and loved ones. All are forced to make rushed decisions in times of crisis and chaos.

What You Can Do To Elevate Your Practice

INERTIA handles the LTC Planning component, so you can stay focused on what you do best without becoming an LTC Expert, offering…..

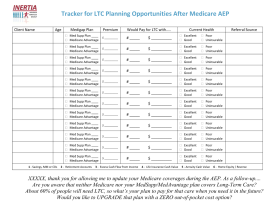

- Customized marketing material to engage clients and prospects for LTC.

- A planning process that includes a HALO™ Assessment to project future care needs & costs.

- Custom, written LTC Plans that align with a client's values and financial strategy.

- Access to insurance-based solutions on your own or with point-of-sale assistance.

Why Partner With INERTIA?

- Deepen your client relationship without expanding your licensing

- Deliver value that no robo-advisor or AI platform can replicate

- Help families avoid chaos, crisis, and resentment when care is needed

Let's Talk! A partner for Long-Term Care Planning collaboration can be invaluable as your clients remain exposed to the risks of needing, and you're leaving significant revenue on the table.

If you're a successful Medicare Professional, let's discuss how you can deliver enhanced planning for clients for Healthcare In Retirement while significantly impacting your bottom line.