Sam & Sue Banks: Long-Term Care Planning And The Look-Alike Roth IRA

Long-Term Care (LTC) costs can be a significant concern even for affluent clients who are in or near retirement. The appeal of LTC Planning is often more about tax benefits, convenience, and integration into estate/financial planning than merely covering the cost of care. With that in mind, consider The Look-Alike Roth IRA strategy as an effective way to begin the LTC Planning discussion.....especially for your high-net-worth clients.

The Look-Alike Roth IRA merges the benefits of a Roth IRA with traditional LTC insurance. However, it only becomes an attractive planning strategy by overcoming the shortcomings of stand-alone LTC insurance and leveraging a Hybrid LTC Planning solution to provide features and benefits such as:

- No Income Caps or Contribution Limits

- Distributions for LTC will be free from federal income tax.

- Cost Certainty as the amount of contributions and duration of those contributions can both be guaranteed.

- Flexibility and control with a "Live, Quit, or Die" value proposition.

- Estate Planning advantage with a TAX-FREE death benefit.

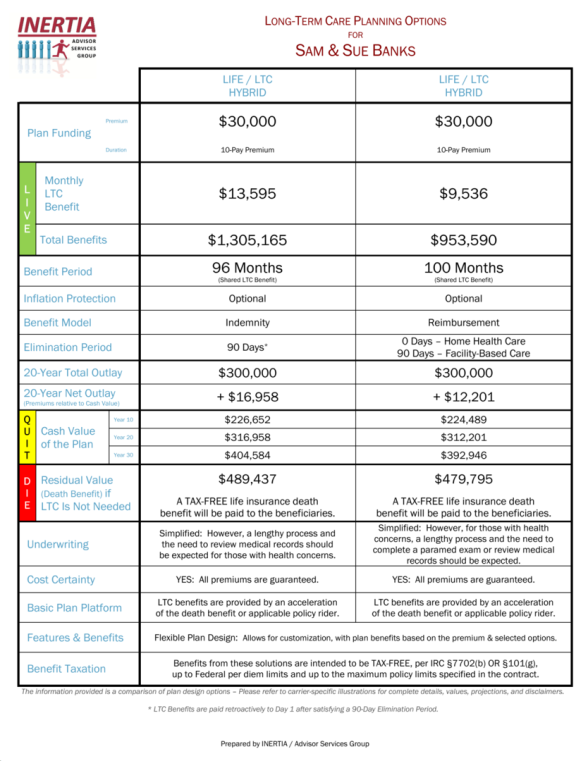

The Look-Alike Roth IRA may not suit every client; however, the case study below can help introduce the concept so you can see how to incorporate the strategy into planning discussions.....

- Sam & Sue are both 60 years old.

- They have approx. $7M in assets in non-qualified and qualified accounts.

- Their CPA advised against a Roth IRA conversion, but they like the concept.

- Their income exceeds the qualification limits for a Roth IRA.

- A HALO Assessment projects a total seven-year need for care.

- Their current Long-Term Care "Plan" would be Self-Fund the cost of care.

- The idea of contributing $30,000/year for 10 years ($300,000) into a Look-Alike Roth IRA LTC Plan is appealing, as it provides:

1) A TAX-FREE pool of funds to pay for care or.....

2) A TAX-FREE death benefit for heirs if care is not required, and.....

3) Control of the contributions should circumstances change.

How many of your clients would appreciate this strategy in their estate and financial planning?

And....Does your current LTC wholesaling resource provide a presentation tool like this?