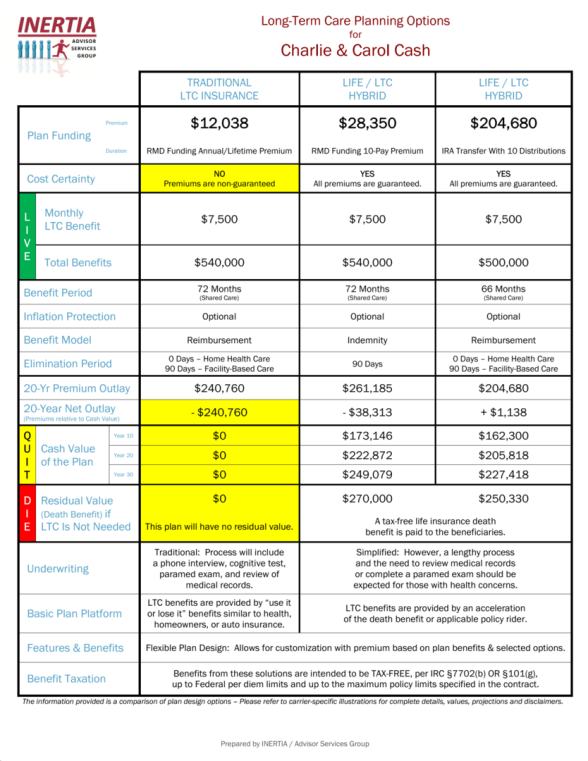

Charlie & Carol Cash: RMDs & Long-Term Care Planning

Far too many American families avoid discussing important issues regarding their aging parents, especially when the discussion has financial implications. However, proactive planning across generations, can often lead to wise long-term decisions. In this case study, we make the following planning assumptions:

-

The couple, both 70 years old, are quite active & healthy.

-

Both receive a pension and Social Security that meets their income needs.

-

They are concerned about becoming a burden on the children/grandchildren.

-

They would “pay for care” with untapped $600,000 in retirement accounts.

-

Carol also sees those accounts as "legacy assets" to pass on what they don't use to their children/grandchildren.

-

The couple must begin taking Required Minimum Distributions (RMD) soon.

-

Their CPA indicates total RMDs for the couple exceed $22,000/year.

-

They complete HALO Assessments projecting a 6-year, $7,500/month combined need for care, likely to begin well into their 90s.

If these were your clients, which option would you recommend to maximize their RMDs and address their comprehensive financial planning goals?

And....Does your current LTC wholesaling resource provide a presentation tool like this?

Age 72 may not be the optimum age to set up a Long-Term Care Plan, but funding the plan with qualified funds can provide substantial benefits and minimize the impact of age affecting the plan.

230807