Betty Boomer: The Risk-Averse Retired Widow & Grandma

Healthcare In Retirement and Long-Term Care (LTC) are important topics for women, especially single, widowed, or divorced women. Many of your female clients in this situation often have children and extended family that no longer live nearby, and those like Betty lack a support system if or when there is a need for care.

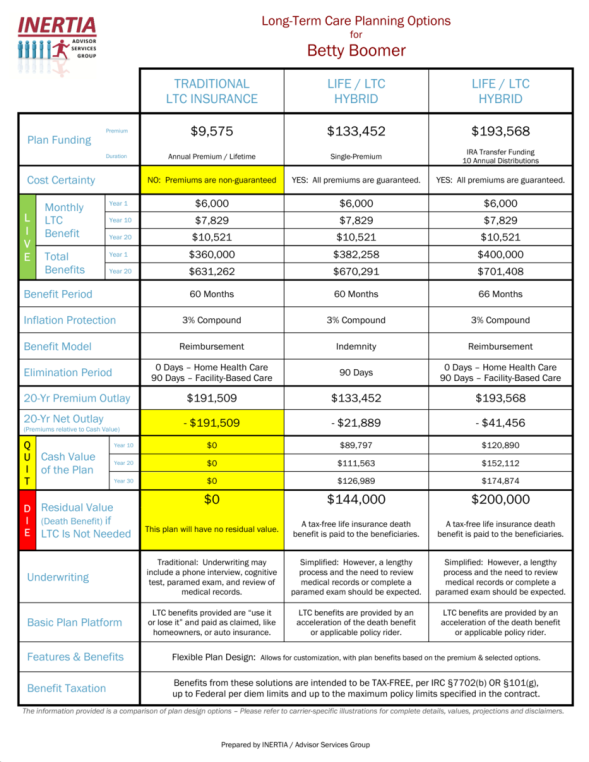

In this case study, we make the following planning assumptions:

- Betty is 65 years old and has $750,000 in assets, with $350,000 in an IRA.

- She has social security and pension income to sufficiently maintain her lifestyle.

- Her Long-Term Care "Plan" would be to tap $200,000 in Low-Risk, Low-Yield deposit accounts, and these are "legacy" assets that could pass to her grandchildren if care is never required.

- Her HALO Assessment projects a five-year, $6,000/month need for care.

If Betty was your client, which of the LTC Planning solutions would you recommend to maximize her funding source and address her comprehensive planning goals?

And....Does your current LTC wholesaling resource provide a presentation tool like this?